Payments

Australia’s all-in-one online direct debit solution

Direct debit payments are an excellent choice for managing subscriptions and instalment payment arrangements.

Direct debit payment system pricing

SecurePay uses a per-transaction pricing model for its online payment gateway. A transaction fee for direct debit transactions will apply.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Best direct debit payment solution for your business

SecurePay provides a direct debit payment solution that enables you to schedule payments providing your customers with more choice when choosing how to pay.

Ready to accept direct debit payments with SecurePay?

Businesses in Australia are constantly seeking ways to streamline their financial operations, and one of the most effective methods is through direct debit. As a direct debit provider in Australia, SecurePay enables your business to give your customers the choice of paying using their BSB and Account number.

Leveraging direct debit payments

Before using a direct debit provider, gain a better understanding of what direct debit is and how it works. Direct debit is a financial transaction process where an individual or business authorises a bank or financial institution to automatically withdraw funds from their bank account to pay for goods or services. This method is widely used for recurring payments, such as subscription-based services, utility bills and membership dues. Direct debit payments provide several benefits, including:

More convenience: Customers appreciate the hassle-free nature of direct debit, as they don't need to remember to make payments manually and can schedule them instead.

Less admin work: Businesses can automate payment collection, reducing the need for manual processing and paperwork.

Improved cash flow: With consistent and predictable payments, businesses can better manage their cash flow.

How to choose a direct debit provider

Selecting the right direct debit provider is essential for the smooth operation of your business. Here are some factors to keep in mind:

Security regulations

Ensure that your direct debit provider complies with the current global standards of online security. Security and fraud protection is a big factor when dealing with financial transactions. SecurePay follows industry-standard security methods to protect both your business and your customers from unwanted access to sensitive data.

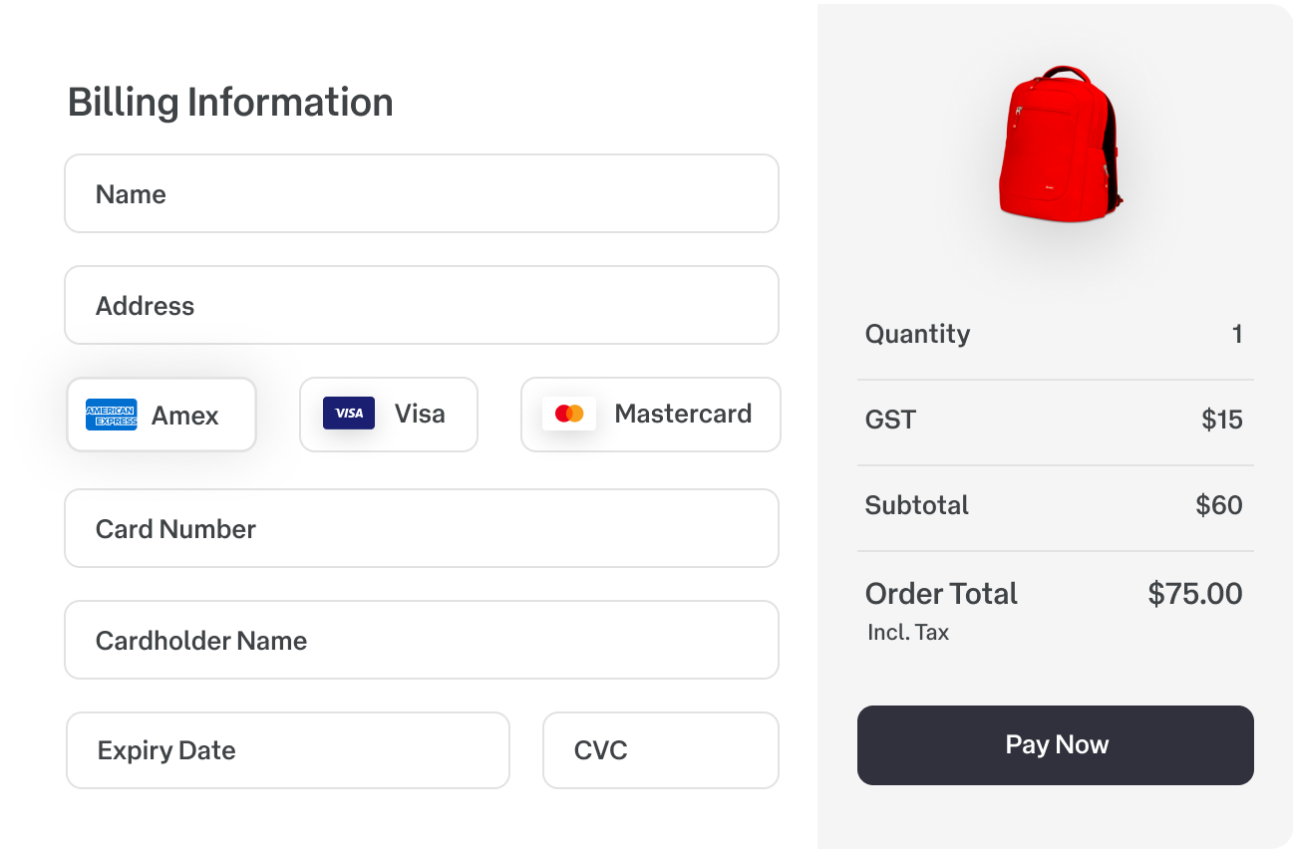

Payment gateway integration

Seamlessly integrate your payment gateway with the direct debit provider, making it easy to set up and manage direct debit payments. SecurePay is an all-in-one solution and can set you up quickly and easily with direct debit payments and a payment gateway.

Pricing structure

Review the pricing and fees of direct debit providers and check that the offer aligns with your business’s budget and structure. SecurePay uses a straightforward and affordable pricing model.

Reporting tools

A good direct debit provider will offer you simple reporting and analytics tools. These can help you track payment performance, identify customer behaviour and make data-driven decisions.

Local support

Having access to a local support team can make a big difference when getting started with direct debit payment integrations. Our SecurePay support team is based in Australia and here to help.

Tips for implementing direct debit payments successfully

Communicate with customers

Inform your customers about your business accepting direct debit payments and its benefits. Ensure they understand the process and can provide their authorisation.

Offer multiple payment options

While direct debit payments are convenient for many customers, some may prefer alternative payment methods. Consider offering multiple payment options to stay flexible and to service various preferences.

Set up recurring payment schedules

Plan your direct debit schedule to align with your customers' needs and preferences. This could include monthly, quarterly or annual payment options.

Start accepting direct debit payments with SecurePay

Choosing the right direct debit provider in Australia can significantly impact your business's efficiency and financial stability. By considering factors like pricing and support, you can make an informed decision. Continually refine your direct debit process and create a seamless and customer-friendly experience. Maximise the benefits of direct debit for your business using SecurePay’s all-in-one solution.