Payments

Discover payment gateway benefits for online transactions

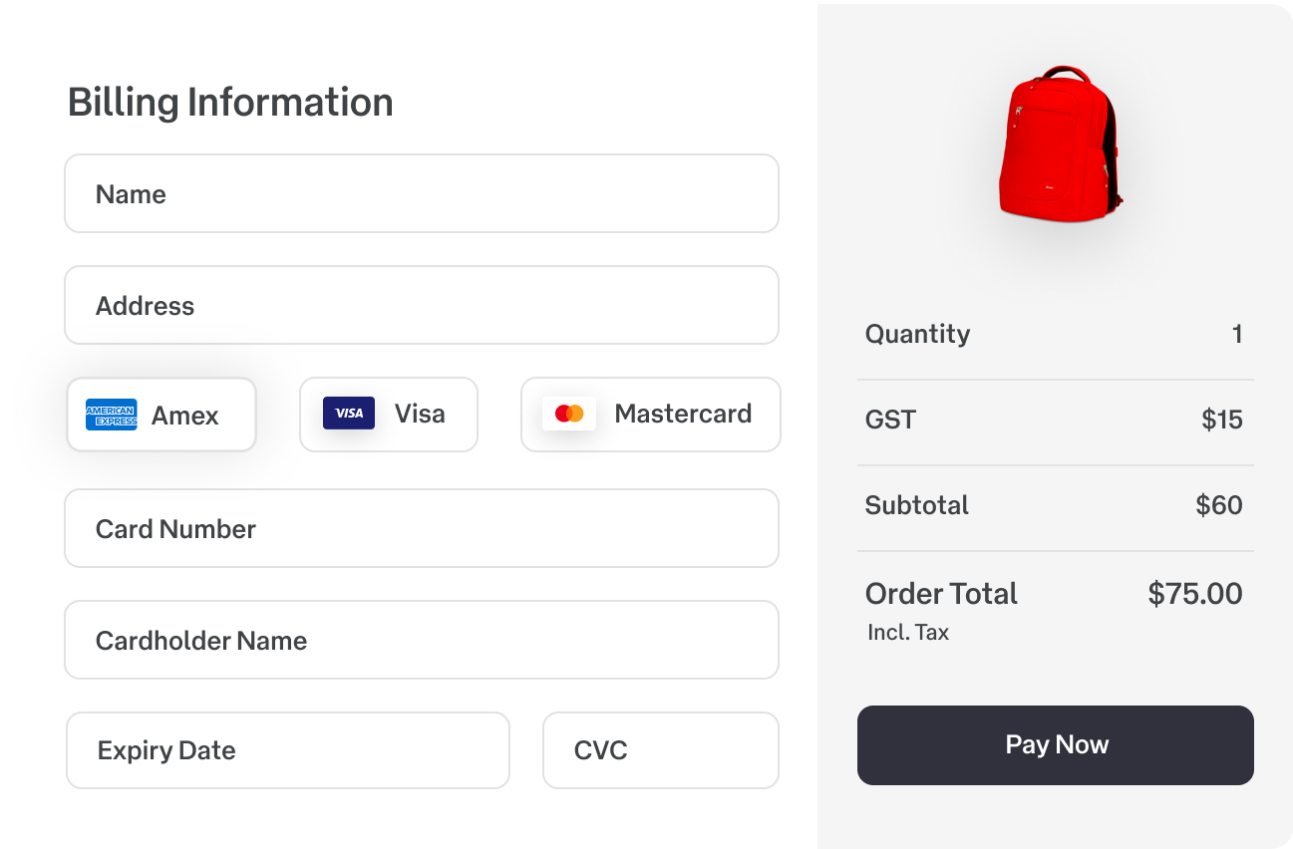

Add seamless payment acceptance to your business with SecurePay. Designed to integrate smoothly with various ecommerce platforms and keeping sensitive personal data protected. Payment gateways provide you with an easy checkout process and faster transactions for your customers.

Payment gateway pricing

Experience transparent pricing with SecurePay's online payment gateway services. We use a straightforward per-transaction pricing model, with no regular, setup, or hidden fees.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Faster transactions to boost your business growth

In a fast-paced world, customers want transactions to be quick and seamless. SecurePay’s payment gateway completes online payments much faster through real-time authorisation and processing. Reach customers from all over the world with Dynamic Currency Conversion which enables cross-border transactions. Provide your customers with transparent fees when they choose to pay in their local currency. Expand your payment options on a global scale to become a key player in international markets.

Enhanced customer data protection

SecurePay is a secure and trustworthy payment gateway for your ecommerce business. Both you and your customers' personal data stays safe with us. We analyse suspicious transactions and unusual payment patterns to give you the most secure payment gateway available. We are constantly scanning and updating our monitoring and tooling to counteract the ever-growing throughs to data and security. Through encryption and various security measures, we make sure to protect sensitive customer data during the entire online transaction process.

Ready to implement SecurePay’s trusted online payment gateway?

Payment gateways help businesses of all sizes with making online transactions. Processing online purchases securely and serving as the financial bridge between customers and merchants, online payment gateways encrypt payment information and authorise the transaction within seconds, making it a secure and convenient payment tool. Understand the full benefits of payment gateways and how they streamline transactions while boosting business growth.

Top 10 benefits of payment gateways

1. Enhanced security

Security is key in the digital world, especially when dealing with sensitive financial data. Payment gateways use encryption and security measures to protect customer data during transactions. They ensure that personal data remains confidential and safe from hackers and unauthorised access. By offering a secure payment environment, payment gateways are a trustworthy method for customers, encouraging them to engage in your business offering with good conscience.

2. Global reach

Unlike some traditional payment methods, with payment gateways you can process transactions from customers all over the world. They support multiple currencies and enable seamless cross-border transactions. Allowing your customers to choose the currency that works for them opens up new international markets for your business on a global scale.

3. Diverse payment options

Different customers prefer different payment methods, ranging from credit/debit cards to digital wallets. Payment gateways accommodate these preferences, offering a wide range of payment options to your customers. By providing diverse payment methods, businesses can cater to a broader customer base and reduce the chances of cart abandonment, ultimately boosting sales.

4. Faster transactions

Most customers expect quick and easy transactions. Payment gateways use real-time authorisation and processing, ensuring that payments are completed faster. A great way to reduce the risk of payment delays!

5. Seamless integration

Payment gateways such as SecurePay are designed to integrate smoothly with various ecommerce platforms and websites. This means that you can quickly set up and activate the payment gateway on your online stores without complex technical processes. Easy payment integration saves time, costs and resources, allowing you to focus on your other business operations instead.

6. Risk management and fraud prevention

Online transactions can come with some risks, such as fraudulent activities. Payment gateways often have fraud detection tools to identify and prevent fraudulent transactions. They analyse transaction patterns, track suspicious activities and implement security protocols to minimise risks, enhance the security of the platform, protect your data and protect both your business and customers from financial losses.

7. Improved cash flow

Payment gateways offer automatic fund transfers to your business account, ensuring a steady and reliable cash flow and helping you to manage your finances more effectively. No more delays in receiving payments or potential cash flow disruptions!

8. Efficient customer support

Payment gateways usually come with dedicated customer support, assisting merchants in resolving any transaction-related issues. Prompt and efficient customer support enhances the overall buying experience, leaving customers satisfied and more likely to return for future purchases.

9. Analytics and insights

Many payment gateways provide valuable analytics and insights into transactional data. You can access detailed data on sales and customer behaviour which will help with making informed business decisions, identifying trends and optimising user journeys or strategies.

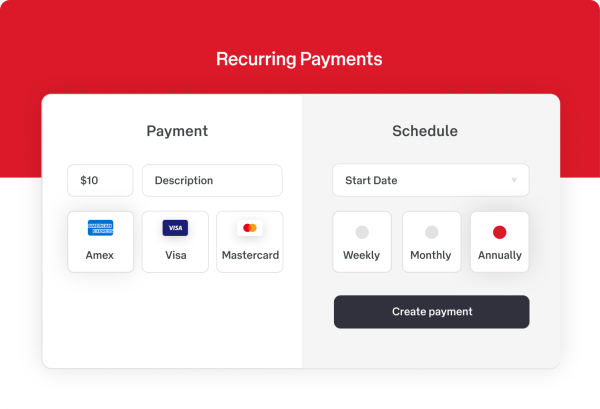

10. Subscription and recurring payments

If you offer subscription-based services or products, payment gateways simplify the process of managing recurring payments. Customers can set up automatic payments, ensuring a seamless experience on both ends.

From enhanced security and international reach to diverse payment options, payment gateways have become a popular choice for online transactions especially for ecommerce businesses. Whether you already have a merchant account or are looking to set up a payment gateway, try SecurePay, a product of Australia Post, and experience user-friendly payment gateway benefits for your own business.