Payments

Set up SecurePay's trustworthy payment gateway

Optimise your online payment experience with a secure payment gateway. Accept a range of payment methods and offer your customers greater flexibility to select their payment preferences. Choose SecurePay for your payment gateway onboarding – our local support team is here to help.

SecurePay Pricing

SecurePay uses a per-transaction pricing model for its online payment gateway. A transaction fee for direct debit transactions will apply.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Flexible and user-friendly payment gateway solution

SecurePay is an all-in-one everyday payment solution provider for your ecommerce business. Create a seamless payment journey for your customers, customise your checkout experience and simply integrate your website with SecurePay.

Advanced data security features

SecurePay keeps you and your customers' financial and personal details safe using robust online security technology. Adhering to current global security standards, your online transactions are protected from fraud providing you with a secure payment gateway solution.

Ready to start accepting payments?

If you have an online business or ecommerce platform, a seamless and secure payment gateway makes a huge difference in accepting online transactions. Payment gateway onboarding is the process of integrating a payment gateway into your online business, ensuring smooth, safe and fast transactions and giving your customer the ability to pay however they prefer.

1. Finding the right payment gateway

The first step in payment gateway onboarding is choosing the most suitable payment gateway for your business model, industry and requirements. Look out for factors like transaction fees, supported payment methods, security and easy integration with your ecommerce platform. Once you are familiar with all the payment gateway benefits, you'll need to sign up for an account. With SecurePay, you can test the payment gateway for free in a “sandbox version” and see how it aligns with your business platform before signing up for a live account.

2. Integration with your website or app

A big part of the payment gateway onboarding process is the integration of the payment gateway with your website or mobile application. Payment gateways should provide APIs (Application Programming Interfaces) and plugins that make integration very straightforward. You or your development team will need to incorporate the gateway's code into your checkout process. This code enables the communication between your website or app, the payment gateway, and the customer's payment method. Setting up your payment gateway with SecurePay is quick and easy. Working with any website type, you can also access detailed documentation and local support. SecurePay is also compatible with most popular ecommerce extensions such as Adobe Commerce, OpenCart, PrestaShop or WooCommerce.

3. Ensuring compliance and security

Safety and fraud protection are critical aspects of payment gateway onboarding, ensuring the security of sensitive customer data during transactions. A payment gateway needs to handle financial data in a secure manner through implementing robust encryption protocols for data transmission, selecting secure hosting environments, considering tokenization to limit data exposure, conducting regular security audits, and also educating staff and customers on security practices. This includes adhering to global security standards and regulations to stay on top of current online security methods. Collectively, having multiple advanced safety steps in place strengthens your data security, safeguards customer information, reduces the risk of unwanted access and enhances your customers’ trust and business's reputation.

4. Improving the payment user experience (UX)

During the payment gateway onboarding, it’s a great chance to review the user experience of your ecommerce business. With a specific focus on mobile optimisation and creating a user-friendly interface, mobile payments have become very popular through the common use of smartphones, making it crucial for businesses to adapt. To optimise the mobile payment experience, consider to streamline the checkout process by minimising the number of steps required to finalise a payment. You can implement features like auto-fill for forms and one-click payments. Additionally, include mobile wallet integrations and enable users to pay effortlessly with popular digital wallets like Apple Pay.

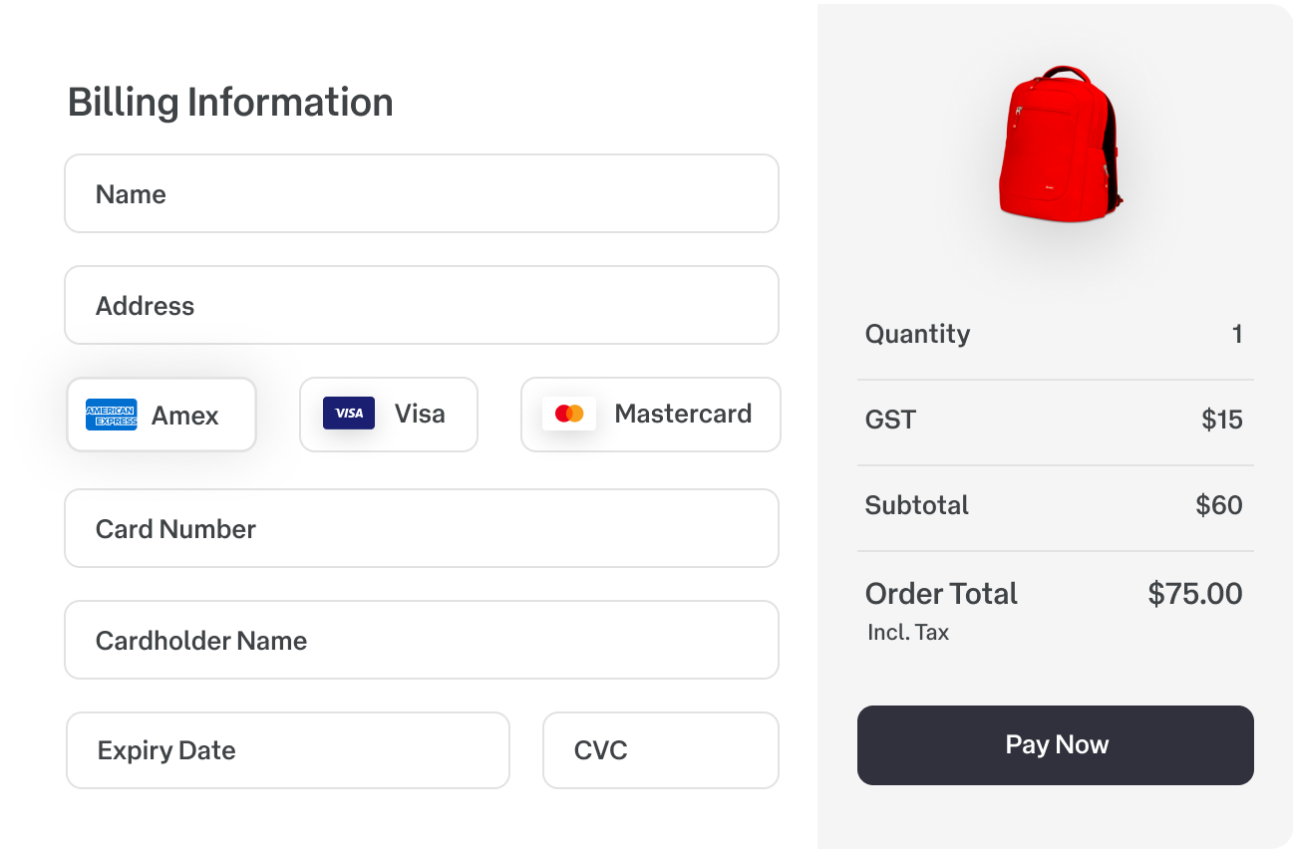

A user-friendly interface also helps in reducing cart abandonment rates. To create an intuitive and straightforward online payment process, it’s important to design a seamless payment flow with clear form fields, real-time feedback on errors or validation and a custom checkout experience that includes your branding. Offer multiple payment options such as credit or debit card payments, including major providers like Visa, MasterCard, American Express, Diners Club and JCB. Giving your customers the flexibility to pay with a wide range of payment options positively enhances your user experience and conversion rates immensely.

5. Maximise your payment gateway features

As you onboard your payment gateway to be able to accept online transactions, look into the extended features it provides to take your ecommerce business to the next level.

Analytics & reporting tools

Monitor your transaction data and continuously optimise the payment process. With SecurePay, you can set up regular reports, view and search your transaction history, process refunds and track your transactions. Simple account management and reporting tools help you to stay on top of your business payments and give you great insights into your customer behaviour. An easy-to-navigate interface allows you to manage user access and permissions, store tokens, download and customise reports and search for specific payments.

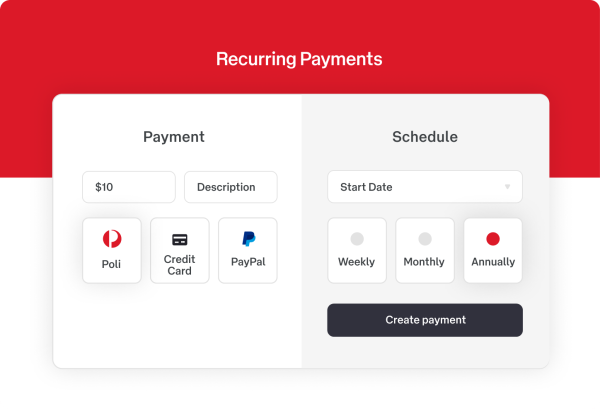

Recurring payments

If your business is based on subscriptions or billing, a payment gateway will help you setting up and managing recurring payments. Capture more revenue through routine payments and grow your platform with automatic payments. Using automated recurring payments reduces the time spent on chasing payments or even debt in case payments have failed. It’s also a favourable option for customers who prefer weekly, monthly or annual subscription models and don’t want to make manual transactions for each time period. Set up recurring payments for greater efficiency, flexibility and user experience.

Dynamic Currency Conversion

Wanting to reach international markets and a wider customer base, taking your payments to the global market can create new opportunities for your business. Start accepting foreign currencies and let your customers pay in their cards local currency through the payment gateway. This means to avoid conversion costs, locking in the exchange rate at the time of transaction and offering improved customer service by helping users to pay in the currency they know. Try a Dynamic Currency Conversion solution to stay transparent, expand your reach and take your business beyond new borders.

SecurePay offers an easy payment gateway onboarding process

A seamless and secure payment gateway onboarding process can enhance your online business. SecurePay’s payment gateway offers excellent compliance, user experience and flexibility, so you can ensure that your customers enjoy an easy payment experience. Start your payment gateway onboarding process with SecurePay – sign up today.