Payments

Trusted payment service provider

Discover secure payment services and benefit from a trustworthy payment gateway and merchant account provider - SecurePay is a flexible payment service provider 1.

Payment service provider pricing

A straightforward per-transaction pricing model for a combination of merchant account and payment gateway services.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

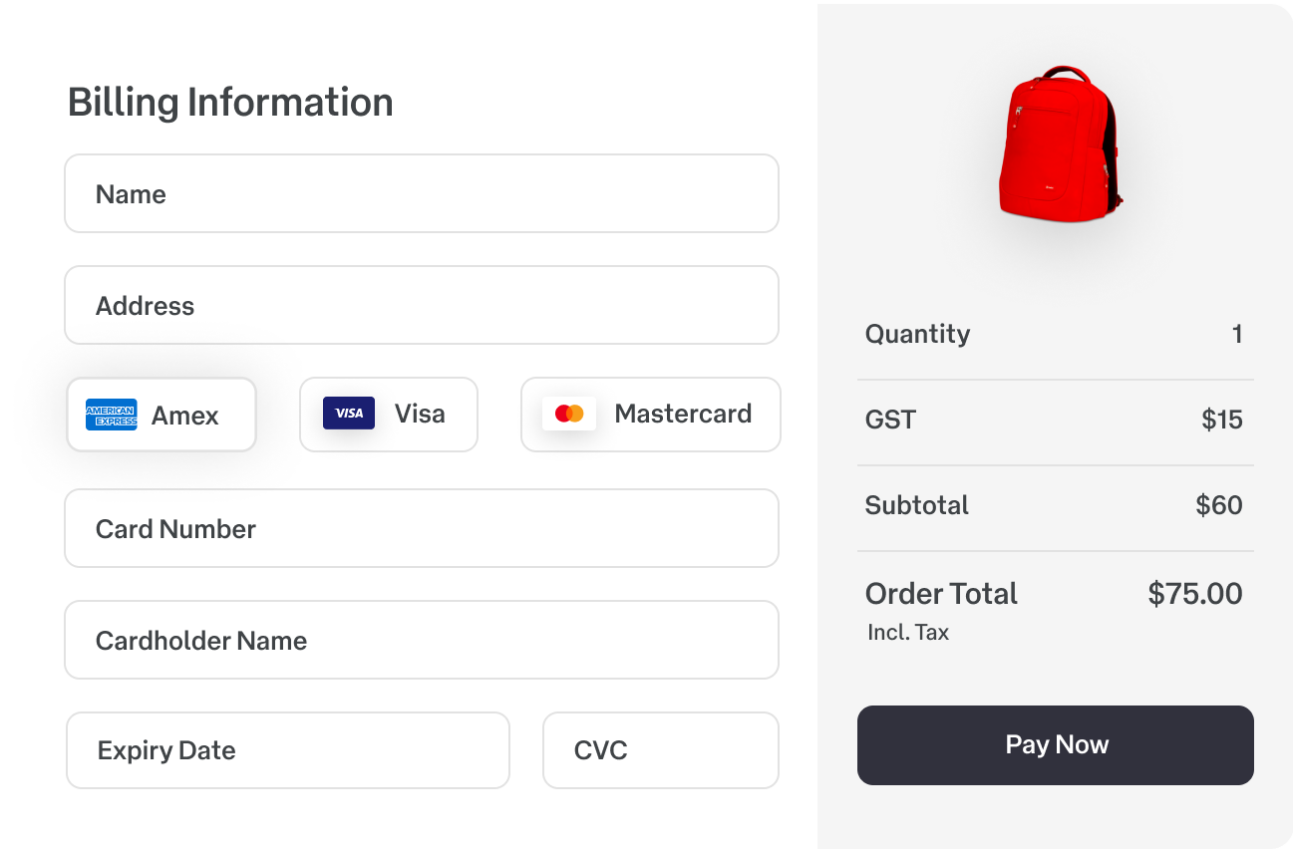

Your everyday online payment service provider

SecurePay is the payment service provider you need for your ecommerce platform or online business. Access detailed reports and local support for everyday transactions.

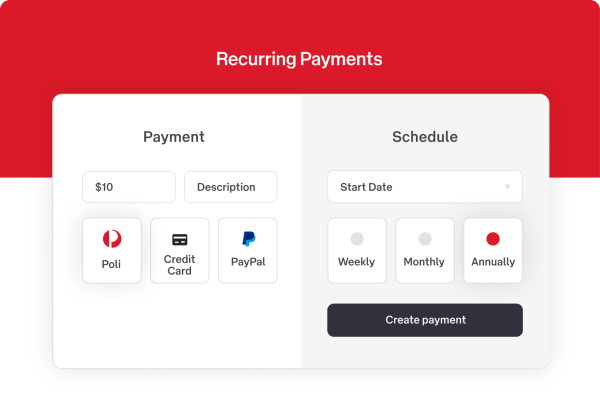

All-in-one payment solution provider

SecurePay offers extensive payment solutions and gives you access to direct debit services and recurring payments.

Ready to choose SecurePay as a trusted payment service provider?

What is a payment service provider?

Payment Service Providers (PSPs), like SecurePay, are known by a few different names, such as Payment Solution Providers or Merchant Service Providers but they are all financial institutions or companies that provide a variety of services to a business enabling them to accept payments. They often act as both a merchant account provider and a payment gateway provider at the same time, helping businesses to collect and manage their payments. A payment service provider enables a merchant to accept and process payments online.

Payment service providers essentially are intermediaries between customers, merchants, and financial institutions, simplifying the complex process of transferring money in the digital landscape. They support a wide range of payment methods, such as credit and debit cards, bank transfers and digital wallets. This is especially important for ecommerce businesses and online retailers who are looking to accept online payments and to create a user-friendly payment experience on their website or app.

Defining your payment processing requirements

Your business requires secure payment services to allow your customers to pay for services or products. In order to determine the payment processing requirements for your business, you should know if you want your customer to pay with credit card, debit card or via their bank account directly (direct debit). You may also require recurring payment functionality where payments will be processed automatically in certain time periods, for example on a weekly, fortnightly, monthly, quarterly or annual basis. In order to evaluate payment service providers, it is important to find the right combination of payment solutions that suit your transaction profile. SecurePay is a payment service provider giving you access to credit card payments, direct debit services, digital wallet services and recurring payment solutions all in one platform.

Types of payment service providers

Internet merchant account providers

An internet merchant account provider could be an acquirer or a payment service provider. They offer businesses access to setup an online merchant account which is a vital component of any ecommerce business. You must have access to an online merchant account if you want to use a payment gateway to process transactions from your website.

A merchant account is an agreement between a retailer, a merchant bank and payment processor for the settlement of card transactions. Internet merchant account providers enable businesses to securely process card payments over the internet, helping you to boost online sales with seamless online transactions.

Online payment gateway providers

An online payment gateway is an interface offered by the payment service provider to enable the business to accept and process digital payments through their website or online platform in a secure and safe manner. When a customer makes a purchase online, the payment service provider encrypts sensitive payment information, such as credit card details, ensuring its safe transmission to the payment processor and the card networks. It then receives the authorisation result, conveying it to the merchant and customer in real time.

Online payment gateway providers usually offer a seamless and user-friendly payment experience, supporting a wide range of payment methods and ensuring compliance with industry standards for data security and transaction processing.

Credit card gateway provider

In Australia, a credit card gateway provider is in its essence the same as an online payment gateway provider. In some countries, not all payment gateway providers offer a credit card payment solution. In Australia, however, the majority of payment gateway providers offer credit card payment services and can therefore be referred to as credit card gateway providers. Catering specifically to the Australian market, SecurePay is known to be a secure and reliable payment services provider. All services align with the Australian banking systems and regulations while operating on global standards and security protocols. SecurePay also provides localised customer support for your business with connecting the payment service solution.

Payment processors

Payment processors are the financial institutions that work in the background to provide all the payment processing services used by an online merchant. Payment processors handle the online transactions between customers, merchants and banks. They securely transmit personal and financial data, verify payment details and make sure that funds are transferred accurately. Payment processors are also responsible for authorising and settling transactions, handling tasks like fraud detection, currency conversion and managing the flow of funds between all parties involved. Most payment processors make reselling agreements with payment gateway providers or merchant account providers in order to provide their services directly to internet merchants.

Direct debit service providers

Direct debit service providers allow your business to automatically withdraw funds from your customers’ bank accounts which is especially common and useful to handle recurring payments. Using direct debit helps you to save money, time, admin work, retain more customers and turn your inconsistent cash flow into predictable revenue. When you set up a direct debit with a customer, you can collect payments straight from their chosen account. This service is widely used for subscription services, utility bills, loan repayments and other regular expenses that can be automated. Direct debit providers facilitate the setup and management of automated payment schedules, ensuring payments are made on time. Most direct debit service providers offer direct debit services as part of their larger service offering. As a payment gateway customer at SecurePay, you can use the direct debit services without any additional set up effort and fees.

Recurring payment providers

Recurring payments mostly occur when a business automatically charges a customer for goods or services on a prearranged schedule. Recurring payments are typically made with a credit or debit card. The customer needs to provide their personal details and financial information and approve permission when the recurring billing starts. Recurring payment service providers help streamline the payment process and create a much more convenient user experience for customers. They can make automated payments and businesses can capture more revenue through the regular payment cycles, commonly weekly, monthly or annually depending on the product or service offering. In line with the direct debit services, recurring payment services are usually part of a larger service offering. SecurePay’s recurring payment services can be used by all our payment gateway users.

How to choose a payment service provider?

First of all, consider if the service offering of the payment service provider actually meets the online payment services you are looking for. Timing and fast processes are also important considerations to stay ahead of the competition and save efforts and costs. Obtaining a merchant account can still be a long and complex process, particularly if you are a new or small business going through the process of setting up a payment service provider for the first time.

Lastly, decide whether you want to go for a local payment service provider and benefit from local support as well as specialised knowledge or a global player. In general, counting on a local support team that works in the Australian timezone can make a big difference for your business and help you much faster to set you up for success.

A product of Australia Post - SecurePay is a payment gateway provider. SecurePay offers merchant services, including online payment solutions, direct debit solutions and recurring payment services.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.