Payments

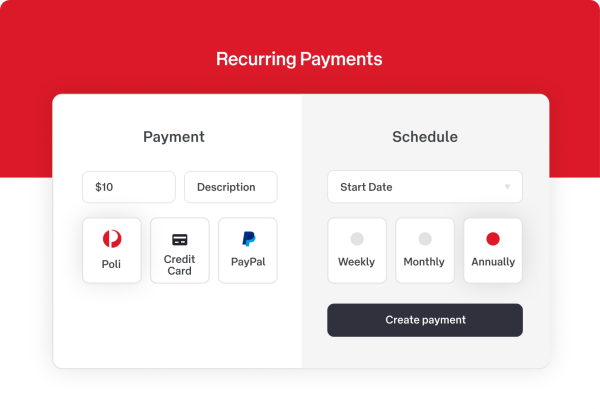

Trusted Recurring Payment System: Set Up Recurring Payments Today

SecurePay offers recurring payment solutions, allowing you to accept and manage recurring payments online 1.

Recurring payment processing solutions pricing

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for its online payment gateway and recurring payments solutions.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Take recurring payments online and help grow your business

A recurring payment solution allows your customers to make repeated automated payments through different payment options, ideal for subscriptions or items that are delivered on a regular basis.

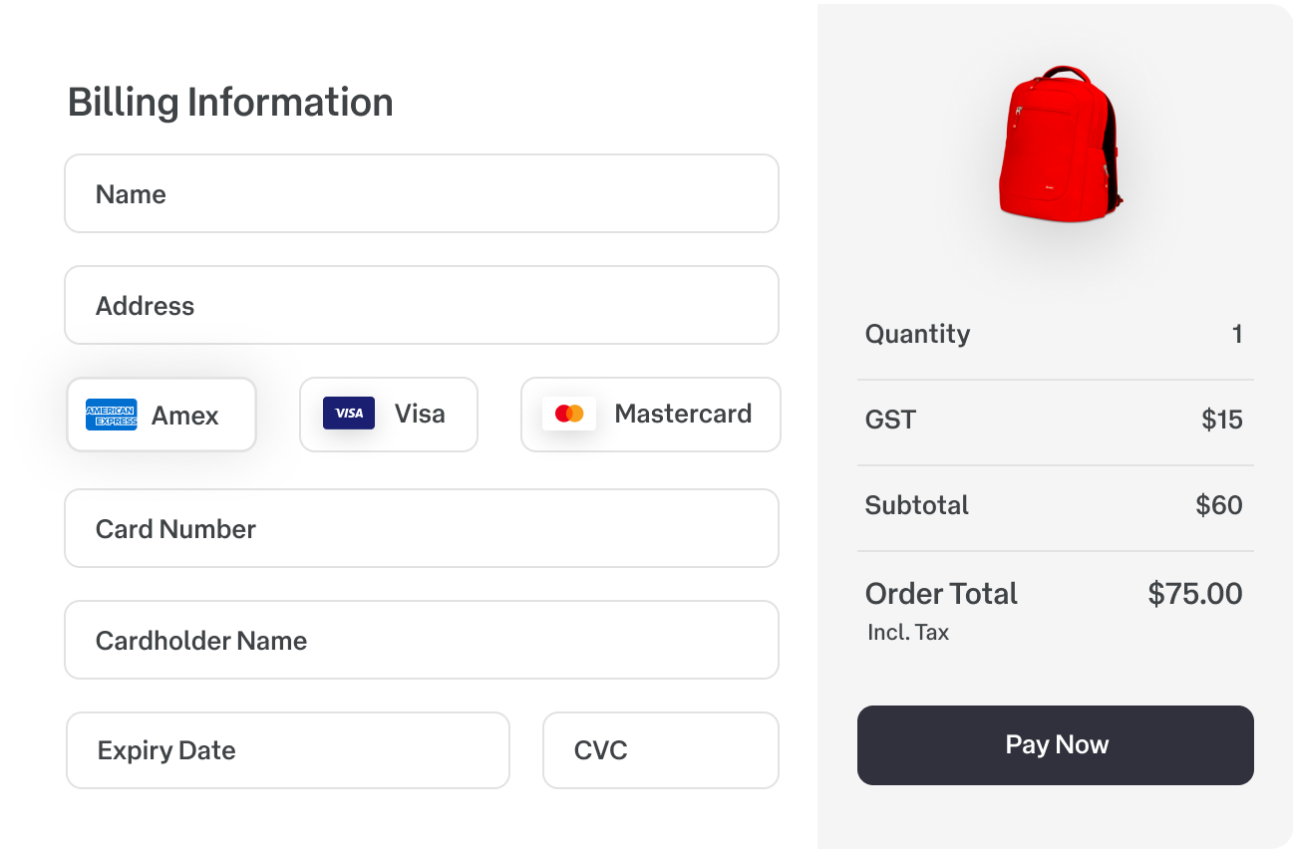

All-in-one recurring payment gateway

Are recurring payments only a part of your online payment service? SecurePay offers a trustworthy online payment gateway, compatible with all major credit cards.

Ready to take recurring payments online?

What is Recurring Billing and how do recurring payments work?

Recurring billing mostly occurs when a business automatically charges a customer for goods or services on a prearranged schedule. The customer needs to provide certain payment details, such as credit or debit card information, and approve permission when the recurring billing starts. During the agreement, the business will automatically make recurring charges to the customer’s credit card or directly debit the customer’s bank with no further permissions needed. This process is a part of the automated recurring payment system.

Are Recurring Payments Effective for Your Traditional and Subscription Businesses?

Recurring payments are here to stay. Traditionally, membership and subscription-based businesses like gyms, insurances, and utilities applied the recurring payments business model. However, any goods or service that a customer subscribes to is a candidate for recurring billing. More recently, service-based businesses such as accountants and marketing agencies started adopting retention-based models. Even for physical products, a recurring payment solution could be valuable. Wholesalers and distributors, who run accounts with their clients, also started implementing automated recurring billing.

A few examples of industries that use recurring payment solutions:

A subscription box where customers receive a box full of goodies regularly

A maintenance plan, think of heating and air-conditioned specialists

Online learning courses who provide access to digital assets

Software as a service provider

Streaming services like Netflix and Spotify

Membership clubs and organisations, such as gyms, libraries, sporting clubs etc.

Utility companies who charge you for service each month

Why a Recurring Payment Solution Will Benefit Your Business Through a Streamlined Payment Process

Recurring payment models are a tactic to help save money, time, retain more customers, and turn your inconsistent cash flow into predictable revenue. The benefits of recurring payments are numerous.

The most important business benefits of a recurring billing model include:

Generate a predictable cash flow: A recurring relationship with your customers is a fantastic way to predict your business’s cash flow. Calculating your income is incredibly easy since you know exactly what you’re going to receive during a specific timeframe. Predictable and secure cash flow is essential for long-term financial planning.

Time-saving: Recurring billing eliminates administrative costs and time associated with tracking invoices and chasing payments.

Improve customer relationships: Customers don’t have to approve payments or remember to make payments, which contributes to a stress-free payment process for customers. Customers are more likely to stay on board thanks to the convenience of automation. This is good news for your customer retention metrics!

Set up Recurring Payments with SecurePay - Australian Based Recurring Payments Explained

SecurePay is a product of Australia Post and is a trusted recurring payment provider in Australia. SecurePay offers recurring payment services for small businesses to enterprise-scale businesses. A few reasons to consider SecurePay as a recurring payment provider:

Top-grade digital security: PCI compliant and award-winning security/anti-fraud solution

Local Australian support: Our Melbourne based support team are here to help 8am to 8pm Mon-Fri

Simple set-up and integration: We will work with most websites and provide detailed documentation

Multiple payment methods: SecurePay facilitates the processing of a wide range of payment methods

If you’re looking for a convenient way to start accepting recurring payments, SecurePay can help. To find out more, simply get in touch with one of our friendly payment experts and we can help you set up recurring payments today.

A product of Australia Post - SecurePay is an online payment gateway and payment solution provider (PSP). SecurePay offers merchant services, including online payment solutions, direct debit solutions and recurring payment services.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.