Payments

High-quality data protection for total peace of mind

Choose SecurePay’s FraudGuard for unmatched online payment security. With real-time fraud detection and multi-layered security, FraudGuard offers advanced protection against unwanted access. A user-friendly interface supports accessibility, enhances trust and customer loyalty.

Online payment services pricing

Experience transparent pricing with SecurePay's online payment gateway services. We use a straightforward per-transaction pricing model, with no setup or hidden fees.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

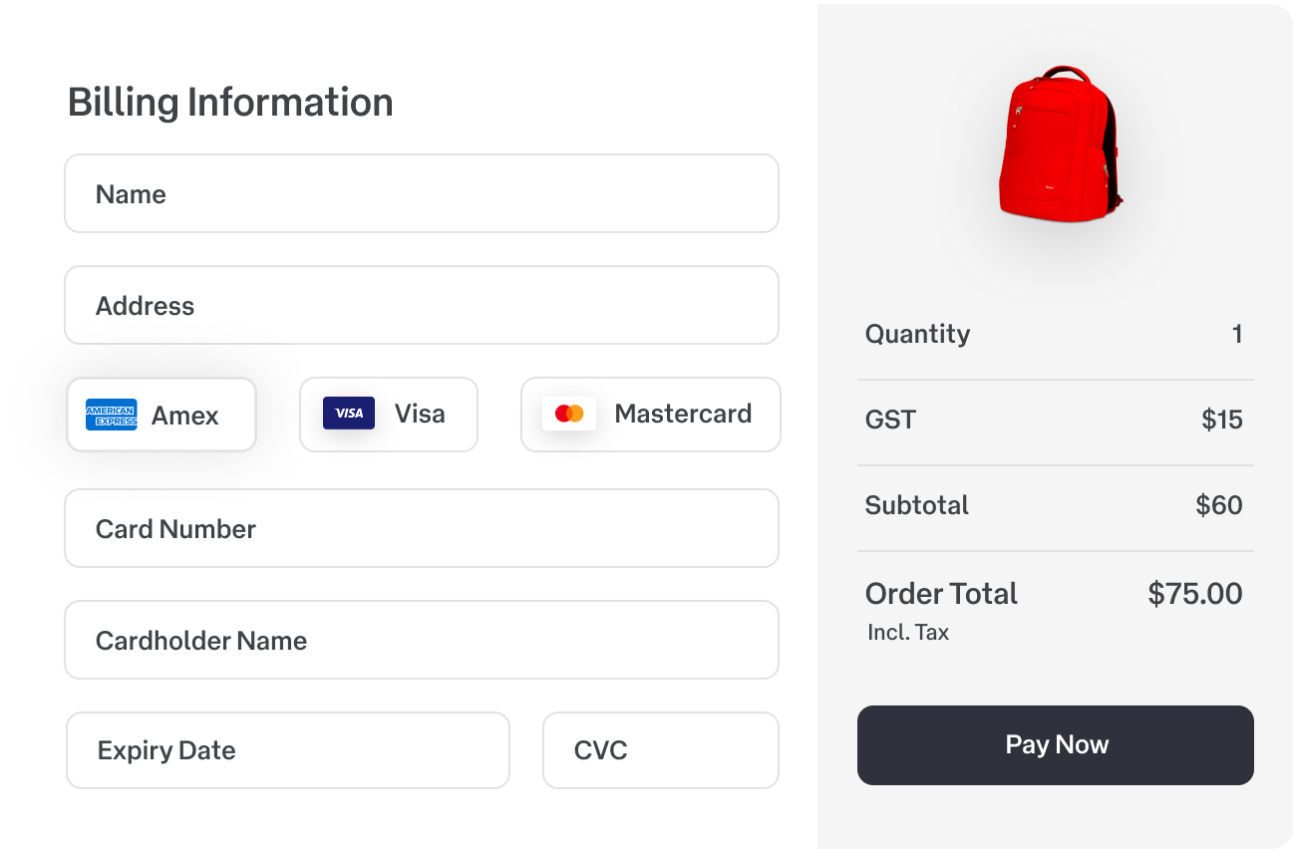

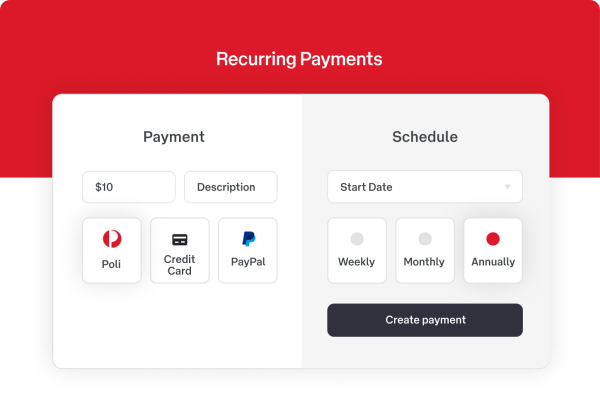

Grow your business with a wide range of payments options

Future-proof your small business and set it up for success by offering your customers more choice when checking out. This includes credit card and debit card payments, Apple Pay and PayPal.

Safe online payments with FraudGuard

Level up your ecommerce business security with SecurePay’s FraudGuard. Rely on a trustworthy online payment solution and maintain a high level of data security which detects suspicious transactions in advance. Using a suite of security protocols, SecurePay provides a safe and seamless online transaction journey.

Ready to implement SecurePay’s trusted online payment services?

Online payments have become an integral part of our daily lives. Shopping online or paying bills – the convenience of making transactions from the comfort of our home is a common expectation in the digital lifestyle. However, with the convenience comes the increased risk of fraud and security breaches. That's where solutions like FraudGuard step in to ensure that your online payments are secure and data is protected.

Building a secure online payment experience

The growth of ecommerce and online banking has changed the way we make financial transactions. While this convenience has simplified our lives, it has also attracted the attention of cybercriminals. Ensuring the security of online payments and safeguarding financial details is crucial for both businesses and consumers.

Protect against fraud: Online payment fraud is a difficult issue, with hackers constantly developing new tactics to gain access to sensitive information. Secure payment solutions like FraudGuard act as a barrier, detecting and preventing fraudulent transactions.

Enhance customer trust: For businesses, maintaining trust with customers is important. Security breaches can quickly lead to financial losses and a damaged reputation. Secure payment systems help your business build trust by assuring your customers that their data is safe.

Adhere to compliance: Following global security and data protection regulations, a secure payment system ensures that the highest standards of technology and security protocols are applied to create a secure payment experience.

Maintain peace of mind: Making online payments can be a sensitive topic for customers if they feel unsure about a payment platform. Knowing that financial information is protected gives your customers the confidence to make transactions without worrying about potential security threats.

Introducing FraudGuard: Your trusted online payment security solution

FraudGuard is an online payment security solution designed to protect your business and customers alike. With its advanced features and robust security protocols, FraudGuard is the go-to choice for safeguarding online payments. Here are some of the key features that make FraudGuard stand out:

Real-time fraud detection: FraudGuard uses specific algorithms to analyse transaction data in real time. It can identify suspicious patterns and anomalies beforehand and instantly flags potentially fraudulent transactions for further review.

Multi-layered security: FraudGuard incorporates multiple layers of security, including encryption and tokenization. These security layers work together to create a solid barrier against unauthorised access.

User-friendly interface: Both businesses and consumers will appreciate the user-friendly interface of FraudGuard. It's easy to set up and use, making secure online payments accessible to all.

How FraudGuard works

FraudGuard takes a comprehensive approach to secure online payments. It allows you to set customised rules that will be applied to all transactions processed. There are many options to set bespoke rules for your business.

Once you have set these parameters, every transaction on your platform will be given a score to determine if a transaction is deemed high risk, low risk or no risk. The score is determined by how many enabled rules are breached and for those breached rules, the number of points decided by you. In increments of 5, 5 being the lowest and 100 the highest amount of points.

This means if a transaction reaches 100 points according to the breached rules, it is deemed as high risk and 1 of 4 actions are taken:

Transaction is declined

Transaction is declined and a notification is sent

Transaction is allowed

Transaction is allowed and a notification is sent

These actions are configured by you at the time you define your FraudGuard rules.

On the other hand, if the transaction scores between 5 and 95 points, it is deemed low risk and you can decide to receive a notification alert instead of blocking the transaction.

Advanced fraud protection with SecurePay

Prioritising safety and security of your financial information is essential for any business no matter its size. FraudGuard becomes a reliable partner in offering advanced security features, real-time monitoring, and adaptive learning capabilities to protect your online payments effectively. With FraudGuard, you can stay in control of online transactions with confidence, knowing that your sensitive data is shielded from fraudulent activity and cyber threats. Fully customisable, FraudGuard integrates smoothly with SecurePay. Learn more about FraudGuard in our FAQ resources or contact our friendly support team on 1300 786 756 (Mon – Fri, 8am – 8pm).

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.