Payments

Trusted online payment solution

Online payment services for businesses of all sizes: SecurePay is a flexible and secure online payment system 1.

Online payment services pricing

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for online payment processing.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Grow your business with a wide range of payments options

Future-proof your small business and set it up for success by offering your customers more choice when checking out. This includes credit card and debit card payments, Apple Pay and PayPal.

All-in-one online payment system

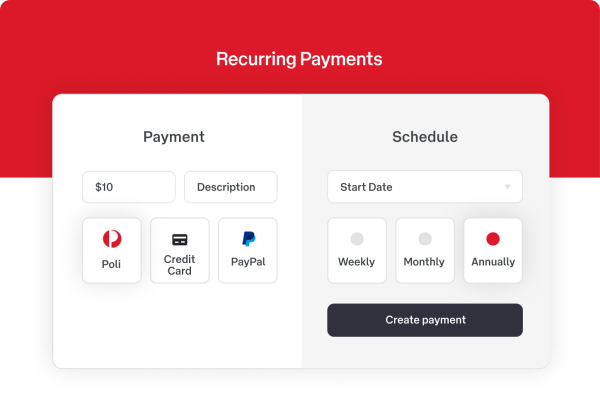

SecurePay offers payment processing services as a complete merchant payment solution or as a payment gateway only service. Additionally, SecurePay enables direct debit payment processing and recurring payments online.

Ready to implement SecurePay’s trusted online payment services?

What are online payment solutions?

Many online shoppers use credit or debit cards. As a business, ideally you want to choose an online payment system that enables your ecommerce store to accept multiple payment methods, such as card transactions online. Online payment solutions aim at simplifying financial online transactions to make the payment process more user-friendly for your customers. An online payment system often consists of several components, including a merchant account which is a bank account that businesses use to accept credit/debit card payments, a payment gateway which manages the cardholder information transfer and a payment processor which manages the card transaction process. This integrated system creates a cohesive mechanism that ensures swift, secure and straightforward online transactions.

Merchant accounts: A merchant account is a bank account, specifically designed for vendors who want to accept credit and debit cards. Merchant providers must obey regulations established by card associations to ensure a standardised and secure environment for financial transactions. Set up a merchant account if you want to offer more flexible payment methods and accommodate payment preferences of your customer base.

Payment gateways: Acting as a secure bridge between the merchant's website and the online payment solution provider, a payment gateway enables the merchant to accept payments through their website in a secure and safe manner. Payment gateways also take data protection seriously and are responsible for transferring sensitive cardholder information in an encrypted manner, reducing the risk of any potential security breaches.

Payment processors: Payment processors actually manage the movement of funds during the transaction process. They authorise or decline transactions based on various factors, and after verifying the transaction's legitimacy, payment processors ensure the funds reach the intended account seamlessly.

Payment solution providers: A payment solution provider is the company that offers online payment services and handles the transactions. They put in place anti-fraud measures to protect both you and your customers, making sure every transaction is secure and sensitive financial data is encrypted.

Note that the payment solution provider often offers both the merchant account as well as the payment gateway.

How to choose the best payment solution?

When choosing your payment service provider, there are several things to consider.

The level of encryption of data should always be a key concern as, visitors to your site should feel safe. Also, consumers will often make a purchase based on the available payment methods. While offering a wide variety of payment options is the norm, extra options might enhance the customer experience.

Above all, a hassle-free experience will help sales dramatically. A negative or troublesome payment experience will most likely lead to a drop in total sales.

There are many good e-commerce payment systems. When choosing a company, there are five crucial factors to consider.

Transaction fees - Payment solution providers typically charge different rates depending on several factors, such as the payment method. Make sure to compare the setup fees, monthly maintenance fees, transaction fees and associated fees. Take into account that the transactions and credit cards that offer customers rewards often include a higher rate. Typically, these are most attractive to your shoppers because they offer givebacks, in airline miles, loyalty points or cash bonuses.

On or off-site transaction processing - Sometimes the system directs the user off your website to complete the transaction. This could negatively affect the payment experience of your customer. Some payment providers offer on and off-site transaction options so consider the experience you want for your customers when deciding.

Available payment methods - As an online store you might differentiate yourself through the payment solutions you offer. This includes credit cards, debit cards, digital wallets, gift cards, bitcoins and other third party payment options.

Fraud protection and chargeback policy - As mentioned before, it's important to seek a payment solution provider that values protection and security. Strong payment gateways will have automated tools that help combat credit card fraud, some of which include the inherent ability to identify and stop suspicious transactions.

Channels for outreach and type of transactions - Consider your own sales channels. Do you want to enable transactions through a mobile application? Are you selling subscriptions that require a recurring transaction? Make sure the payment solution providers offer the payment services that meet your demands.

Implementing your online payment solution

Find an online payment solution that aligns seamlessly with your business requirements. The first step involves integrating the online payment service into your ecommerce platform. This includes collaborating with your chosen payment solution provider to embed their system within your website's architecture. SecurePay offers easy payment integrations that work with any website type. You can also test our online payment solution for free. SecurePay provides a "sandbox version", giving you access to test it on your website before signing up for a live account.

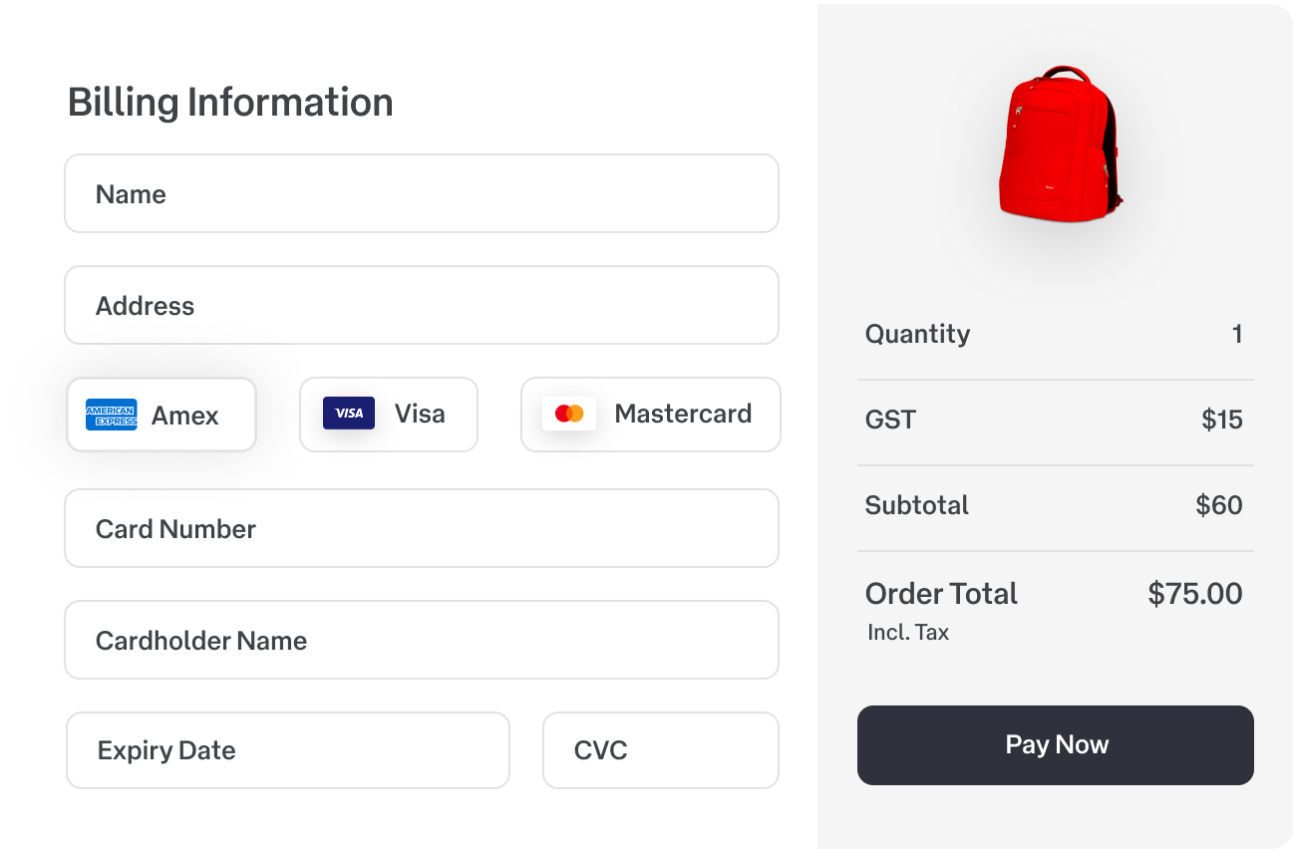

Custom interface

Next, ideally you want to tailor the payment interface to resonate with your brand guidelines, offering customers a consistent and trustworthy experience. As a guiding principle we recommend to streamline the payment process and only ask for most essential information to complete a transaction. This helps with improving potential cart abandonment too. Create a customised checkout experience for your customer base with SecurePay and stay in control with our user-friendly card payments interface.

Security

Implementing a secure online payment solution is important for both your customers and your business. Ensure the security features of your chosen online payment system adheres to global standards of online security. You want to be sure that the online transactions are protected from potential cyber threats and unwanted access. SecurePay will help keep personal data safe and uses various security methods to detect fraud in advance and maintain data security of the highest standard.

Ready to go live

Before making your online payment solution live, start testing it across various payment scenarios to identify and fix any potential glitches or issues. Simulate different payment frameworks, including successful transactions, declined payments and potential errors, to ensure a seamless user experience for your customers. Also use reporting tools to gain insights into your transaction history, payment processes and customer behaviour.

By seamlessly integrating your online payment solution into your platform, prioritising security and testing carefully, you can offer your customers a seamless, secure and user-friendly payment experience that reflects your business offering.

A product of Australia Post - SecurePay is a payment gateway and payment service provider. SecurePay offers merchant services, including online payment, direct debit and recurring payment processing.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.