Payments

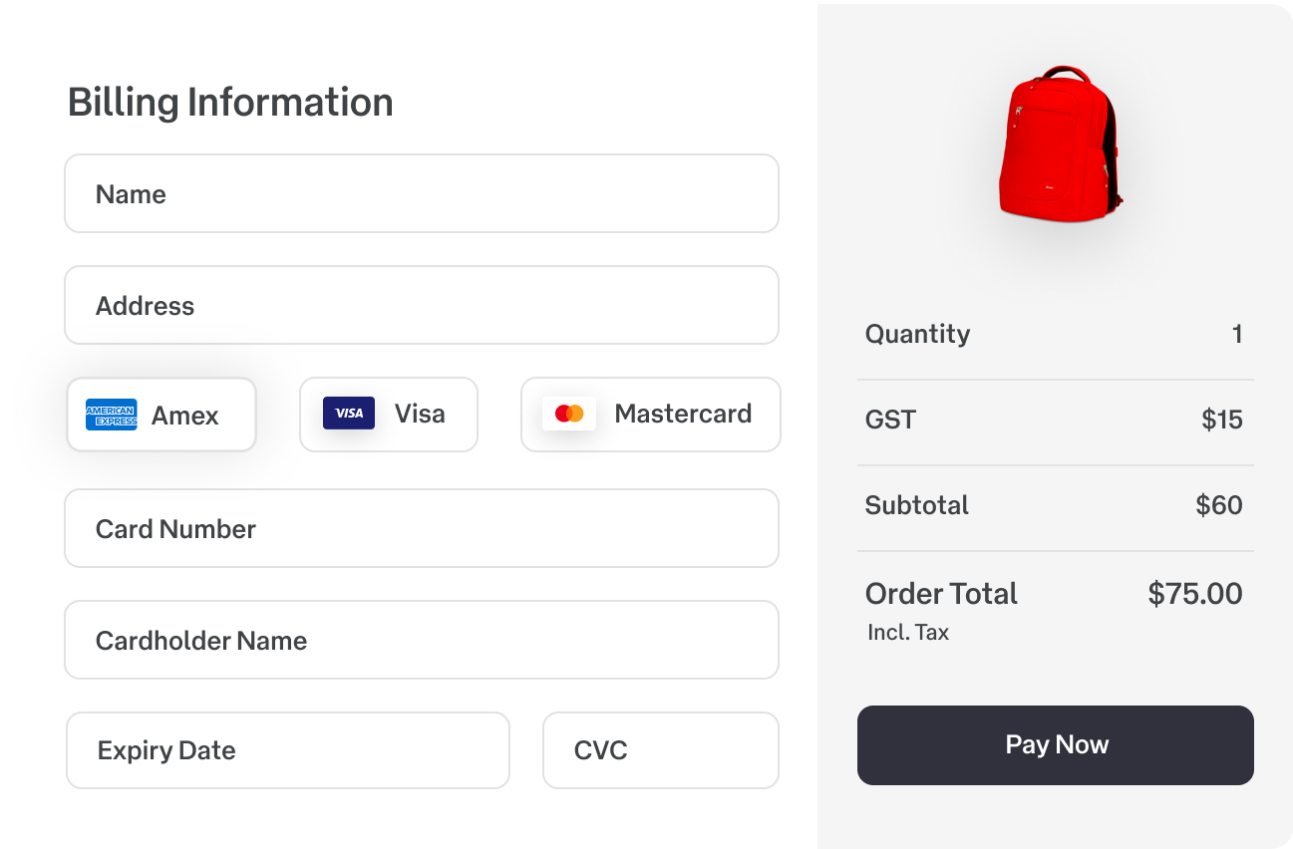

Payment gateway security keeps your transactions safe

Simply pay online and leave sensitive data in the secure hands of SecurePay. Our key focus is on payment gateway security and ensuring your customers' sensitive financial data is protected from unwanted access. Seamlessly make everyday online payments, backed by various security measures. Elevate your ecommerce business with a trustworthy payment gateway experience.

Payment gateway pricing

Experience transparent pricing with SecurePay's online payment gateway services. We use a straightforward per-transaction pricing model, with no regular, setup, or hidden fees.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Seamlessly integrated security technology

SecurePay uses strong encryption, applies advanced tokenization and follows global compliance to guard your valuable payment data. We deliver a secure payment gateway online transaction experience with the highest technology requirements in place to protect sensitive customer data and prevent fraudulent activities.

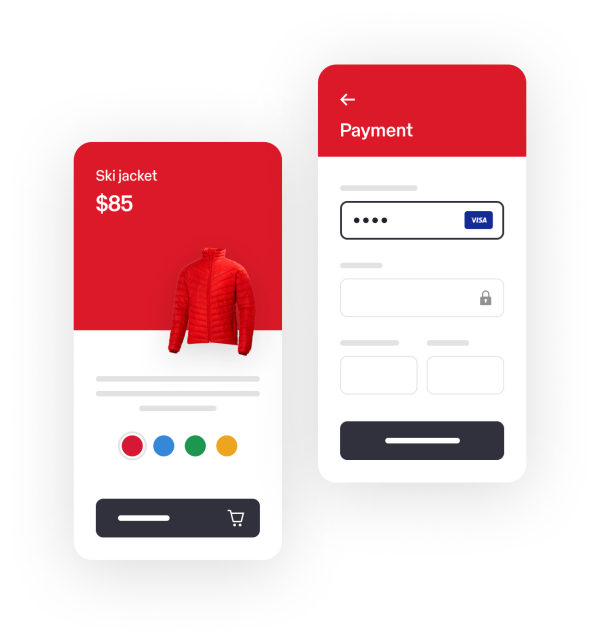

Making safe online payments

Upgrade your ecommerce business security with SecurePay. Being your reliable payment gateway solution, customer data protection is important to us and we use multiple safety methods to maintain a high level of data security and detect suspicious transactions in advance and therefore allowing us to declined or block them. Through advanced encryption and a suite of security protocols, SecurePay provides a safe and seamless online transaction journey.

Ready to use SecurePay’s secure payment gateway?

From ecommerce to mobile banking and digital payments – ensuring the security of sensitive financial information is important for businesses and consumers alike. One essential benefit of payment gateways is the integrated security technology for users to make safe online transactions.

Payment gateways act as an intermediary between a merchant's website and the financial institution that processes the transaction. Its primary function is to securely transmit payment data from the customer to the relevant bank, ensuring that the transaction is completed seamlessly.

How payment gateway security works with SecurePay

1. Encryption

One of the fundamental components of payment gateway security is encryption. When a customer starts a transaction, the payment gateway encrypts the sensitive financial data, including credit card details or banking credentials, before transmitting it online. Encryption ensures that the data is turned into an unreadable format during transit, reducing the risk of fraud.

2. Tokenization

Adding an extra layer of security, SecurePay’s payment gateway uses tokenization. Tokenization allows a merchant to trigger payments using a unique value instead of their customers card number. This token acts as a substitute for the sensitive information, making it useless for bad actors even if they would manage to intercept it. The actual card data is securely stored in the payment gateway provider's server which minimises the risk of data breaches.

3. Secure Sockets Layer (SSL) certificates

Payment gateways use SSL certificates, which establish a secure and encrypted connection between the customer's browser and the merchant's server. SSL certificates are represented by "https://" in the website's URL and are essential in safeguarding sensitive information during transmission.

4. Two-Factor Authentication (2FA)

Two-factor authentication built into the payment process is another layer of security that payment gateways can provide. For example, a user can get a one-time password (OTP) sent to their phone to make sure there is no unauthorised access to accounts. With Two-factor authentication in place, customers can identify and monitor suspicious activities and track their transactions, overseeing failed transaction attempts, access from unfamiliar locations or fraudulent behaviour.

5. Compliance

SecurePay is designed to comply with international security standards, enabling businesses to expand their reach globally while providing customers with secure online transactions. Complying with the Payment Card Industry Data Security Standard (PCI DSS), security standards also ensure financial information is handled securely and in accordance with industry best practices.

Make safe online payments with SecurePay

SecurePay puts payment gateway security at the forefront when creating a seamless and safe transaction process. Businesses and customers can enjoy making online payments easily and quickly with thorough security measures in place through their merchant account. Using robust encryption, applying tokenization and following global compliance, SecurePay protects your sensitive financial data and offers a trustworthy transaction experience. Thrive in the ecommerce world and gain the benefits of payment gateways with SecurePay to enable a seamless online shopping experience for your business.