Payments

Online Payment Gateway Australia - A Trusted Payment Provider for Online Business

SecurePay, a trusted Australian online payment gateway, provides a flexible and secure online payment gateway solution for your online business. As a leading payment processor, we offer one of the best payment gateway solutions in Australia, ensuring seamless transactions for your online store.

Payment gateway pricing

Experience transparent pricing with SecurePay's online payment gateway services. We use a straightforward per-transaction pricing model, with no regular, setup, or hidden fees.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

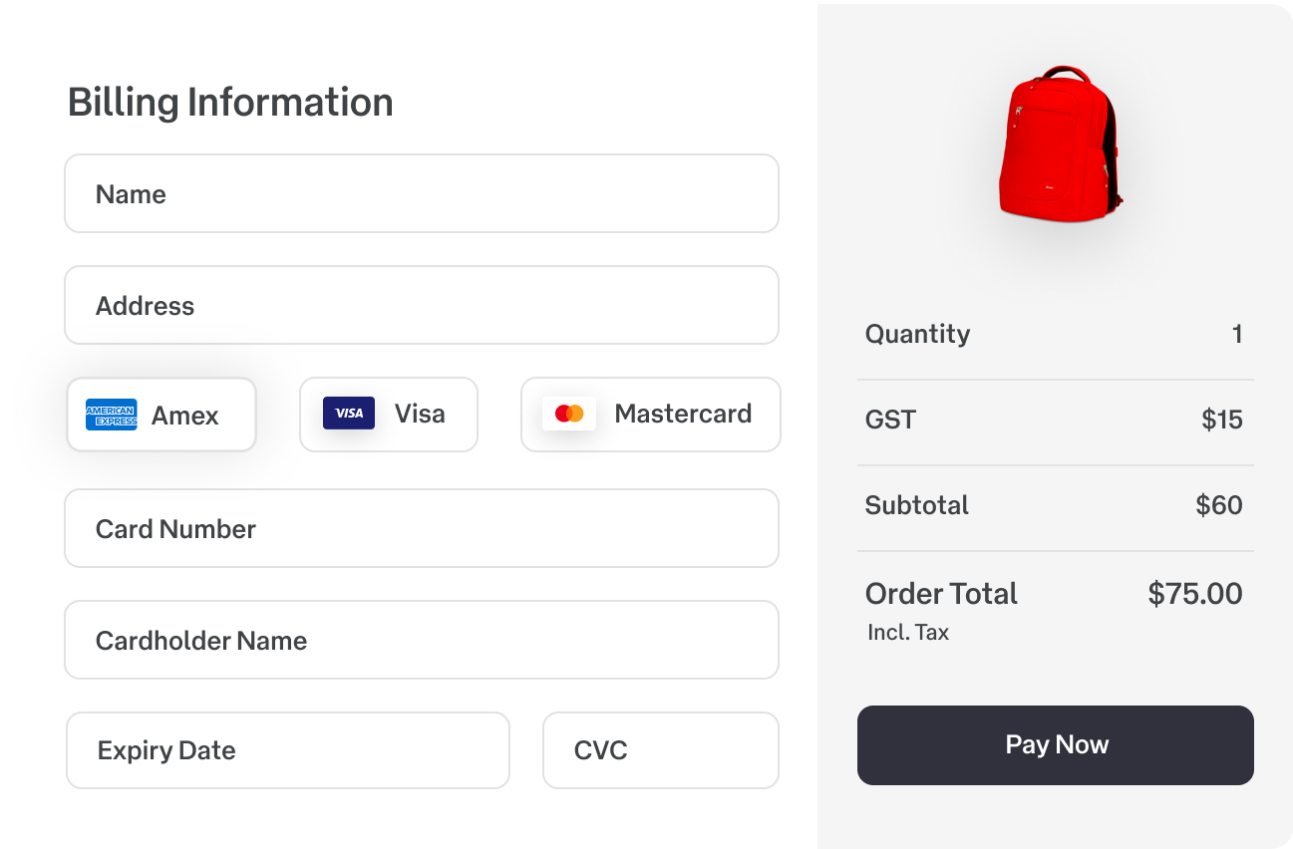

Everyday online payment gateway solution

Use our internet payment gateway for your e-commerce store or online business. Access detailed reports and local support for everyday transactions 1.

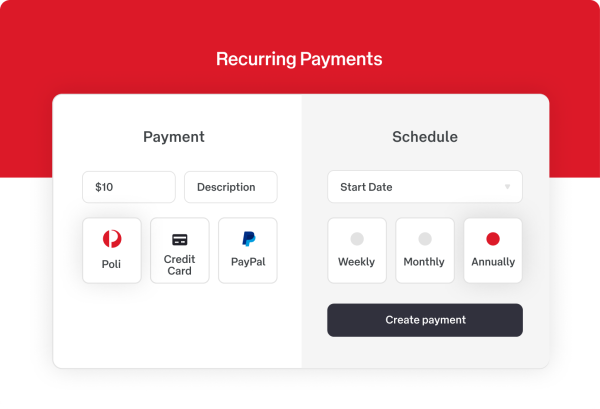

All-in-one Australian payment gateway solution

SecurePay's internet payment gateway can also be used as a direct debit gateway or recurring payment gateway.

Ready to implement SecurePay’s trusted online payment gateway?

What is a Payment Gateway?

An online payment gateway is an interface that connects your business's website with secure payment back-end systems that process payments. It enables your online business to accept payments securely, making it an essential tool for e-commerce and mobile applications. SecurePay, voted the best payment gateway in Australia (NORA Solution Partner Award Best Payments Gateway 2022), simplifies the payment process, allowing your online store to accept credit and debit card payments with ease.

55% of Australian online shoppers preferred payment method for online purchases are credit or debit cards. An online payment gateway, like SecurePay, links your web shop with your chosen merchant settlement account, processing the credit card information and ensuring the payment is received. It acts as a secure conduit for online transactions, moving funds automatically from the customer to the retailer.

With the help of payment gateway services like SecurePay, it becomes easy for websites to accept different types of online payments. Most payment gateways offer many choices when it comes to taking payments online. This includes options like API integrations, hosted payment pages and shopping cart integrations. It also offers security features to help protect you from fraudulent customers. For many small-scale merchants, the ease of a payment gateway is a good way to gain access to e-commerce solutions.

How a Payment Gateway Works

A payment gateway facilitates online payments, exchanging information between the business website and the chosen merchant settlement account. It acts as a secure and agnostic third party, processing payments made by customers and transferring them to the business's account.

Payment gateways execute a very vital part of online transactions. They authorise or facilitate the authorisation of all the payments in a transaction between customers and businesses. This means the effective performance of your payment gateway is vital to help build security and trust with your customers.

A payment gateway codes all individual information and payment details. Credit card details, financial information, and other sensitive information are coded to allow it to be exchanged between seller and buyer without being visible to others.

A payment gateway takes security very seriously, especially when it comes to individual information and payment details. Credit card details, financial information, and other sensitive information are securely exchanged between seller and buyer without being visible to others.

SecurePay, is a product of Australia Post, is a leading payment service provider. We offer comprehensive merchant services, including online payment processing, direct debit services, and recurring payment solutions, making Securepay one of the best payment gateways in Australia for 2023.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.

FAQ on Payment Gateways

What is the best payment gateway in Australia?

The best payment gateway in Australia is subjective and depends on the specific needs of your business. However, SecurePay is a popular choice due to its robust payment processing system, fraud protection, and ability to accept a wide range of payment options, including credit card payments, digital wallets, and third-party payment services. Additionally, SecurePay is backed by Australia Post and one of only a handful of Australian based payment gateway providers.

What is a payment processor and how does it work?

A payment processor is a company that manages transactions between the merchant and the customer's bank or credit card company. It verifies the transaction details, ensures the funds are available, and enables the transfer of funds. The payment processor also provides tools and services for businesses to manage these transactions, such as APIs and integration with ecommerce platforms like WooCommerce and Magento.

What is the difference between a payment gateway and a merchant account?

A payment gateway is a service that securely transmits payment information from the customer to the merchant's payment processor. A merchant account, on the other hand, is a type of bank account that allows businesses to accept payments via debit and credit cards. The payment gateway you choose would need to support the bank where you have chosen to open your merchant account. SecurePay supports most major banks in Australia allowing you to bring your own merchant account.

How do I choose the right payment gateway for my business?

Choosing the right payment gateway depends on several factors, including the types of payments you want to accept (credit cards, direct debit, international payments, etc.), the ecommerce platform you're using, the transaction fees charged by the gateway provider, and whether they offer multi-currency support (Dynamic Currency Conversion). You may also want to look at their fraud protection measures, customer service, and whether they allow customers to stay on your site during the checkout process.

What is a payment solution and why is it important for my business?

A payment solution encompasses the services and technologies that enable your business to accept and process payments online. This can include a payment gateway, a payment processor, a merchant account, and ecommerce software. A robust payment solution is crucial for any business owner as it allows you to securely accept payments, provides a smooth checkout experience for your customers, and can integrate with other tools and services you use in your business.

What sets Securepay apart from other popular payment service providers?

SecurePay, as an Australian-based service provider, distinguishes itself by prioritising data sovereignty. In contrast, many global competitors, all customer data managed by SecurePay stays in Australia, enhancing security and compliance with local data protection regulations.

This commitment to local data storage mitigates cross-border data risks, ensuring a higher level of data privacy and integrity for clients, and provides an unmatched level of trust in SecurePay's services. Our dedication to safeguarding client data signifies a deep respect for Australian standards, reflecting our core values of transparency and responsibility. Get started here

What is a payment gateway provider and what do they do?

A payment gateway provider is a service that authorises or supports the authorisation of credit card payments for ecommerce businesses. They provide a secure pathway between a customer's bank and the online store to safely transmit payment information. Payment gateway providers may also offer additional services such as fraud protection, dynamic currency conversion (DCC), and integration with various ecommerce platforms.

What should I look for in a payment gateway?

When choosing a payment gateway, consider factors such as transaction fees, types of payments accepted, security measures, integration with your ecommerce platform, and local customer support. You should also check whether the gateway supports international payments if you plan to sell globally. It's important to choose a gateway that fits your business needs and provides a seamless and secure checkout process for your customers.

Can a payment gateway hurt my business?

A poorly chosen payment gateway can potentially hurt your business. For example, if the gateway doesn't provide a smooth and secure checkout process, it could lead to abandoned carts and lost sales. High transaction fees can also eat into your profits. Therefore, it's important to carefully choose the right payment gateway that aligns with your business needs and provides a positive experience for your customers.

What are the typical fees associated with payment gateways?

Payment gateways typically charge a transaction fee for each transaction processed. This can be a flat fee, a percentage of the transaction amount, or a combination of both. Some payment gateways may also charge setup fees, monthly fees, and additional fees for services like fraud protection. It's important to understand all the fees associated with a payment gateway before choosing one for your business.

How can I start taking payments with a payment gateway?

To start taking payments with a payment gateway, you'll first need to set up a merchant account. Some payment gateway providers, such as SecurePay’s all-in-one online payment solution, provide a merchant account as part of their product offering. Alternatively you can obtain your own merchant account with an acquirer of your choice and use SecurePay’s payment gateway. Once you have chosen a payment gateway that suits your business needs, you will need to sign up for their service, and integrate the gateway with your online store using their API or a plugin for your ecommerce platform.

What is the perfect payment gateway for an online business?

The perfect payment gateway for an online business depends on the specific needs and requirements of the business. Factors to consider include the types of payments you want to accept, the ecommerce platform you're using, the transaction fees, and the level of customer support provided. SecurePay is a popular choice due to its robust features, security measures, and ability to integrate with various ecommerce platforms.

Can I accept international payments with a payment gateway?

Yes, many payment gateways allow you to accept international payments. They can support multiple currencies and offer conversion services. However, it's important to note that there may be additional fees associated with international transactions. Always check with your payment gateway provider to understand their policies and fees for international payments.

What are some payment gateways that integrate with WooCommerce and Magento?

Many payment gateways integrate with popular ecommerce platforms like WooCommerce and Magento. Some of these include SecurePay, Eway, and Pin Payments. These gateways provide plugins or APIs that make it easy to integrate their services with your online store, allowing you to offer a seamless checkout experience for your customers.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.