Take your payments global with SecurePay’s multi-currency payment gateway

Accept foreign currency payments for your business. With SecurePay’s Dynamic Currency Conversion solution you can offer your customers more payment options and help them avoid conversion costs when they choose to pay in the currency of their card.

What is Dynamic Currency Conversion?

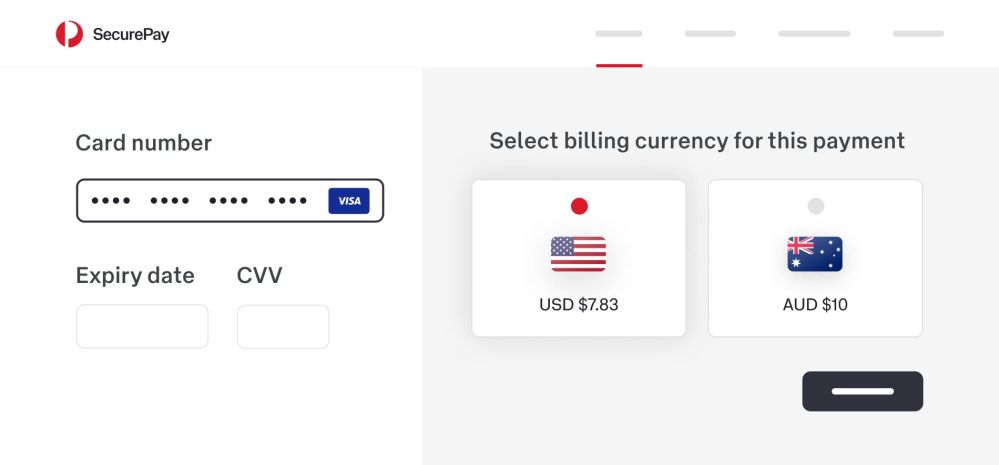

Dynamic Currency Conversion (DCC) is a process in which your customers can make payments on their credit card in the currency of the card’s country of issue when purchasing products or services through your website or app.

When your customer, from another country chooses to pay in their own local currency, they lock in the exchange rate at the time of transaction and it remains the same for the lifecycle of the payment. This helps customers see prices and make payments in their preferred currency, improving the user experience. They also won’t have any surprises when they see their bank statement a few weeks later.

Dynamic currency – how it works for your business

Dynamic Currency Conversion benefits

Help expand your reach

DCC enables you to expand overseas and attain new international customers.

Help reduce risk of abandoned sales

Avoid losing customers at the checkout due to uncertainty of fees and exchange rate.

Potential cost savings

You are entitled to a rebate to offset your merchant service fee. T&Cs apply

Simple settlements and reconciliation

Unlike other DCC solutions, with SecurePay you only need one merchant account to manage all supported currencies, and funds are settled in your account in AUD.

Offer certainty

With DCC, the exchange rate is displayed for your customer at checkout, and it remains the same for the lifecycle of the transaction.

Improved customer experience

Provide your customers options and the choice to pay with the currency they are familiar with.

2.90% + $0.30 AUD

International cards

Fees include GST.

Simple and transparent pricing

You are charged our international fee per transaction and you are entitled to a rebate for each DCC transaction.

Getting started

Available through API Integration

Dynamic Currency Conversion is only available on our 'All-in-one' SecurePay product and through the SecurePay API integration.

Sign up

Sign up for SecurePay and enable Dynamic Currency Conversion to start accepting foreign currency transactions.

Existing customers

If you are already integrated with SecurePay API and would like to enable Dynamic Currency Conversion on your SecurePay account, login to your account.

Want to learn more about Dynamic Currency Conversion?

What is a multi-currency payment gateway?

A multi-currency payment gateway is a financial technology service that allows businesses to accept payments in multiple currencies from customers around the world. It is typically used in ecommerce and online businesses to facilitate international transactions and expand their customer base globally.

Currency conversion: When a customer from an international market makes a purchase on a website or app, the multi-currency payment gateway automatically converts the transaction amount from the merchant's chosen currency to the customer's local currency.

International payment methods: payment gateways support various payment methods commonly used in different regions, such as credit cards, debit cards, digital wallets (e.g., PayPal), and local payment options. This ensures that customers can pay using their preferred payment methods. It should be noted that DCC is only available when paying with Visa or Mastercard.

Localisation: Multi-currency payment gateways often provide localisation features, such as displaying prices in the customer's currency, language preferences, and even localised checkout experiences to make the buying process more familiar and comfortable for customers from different countries.

Risk management: Multi-currency payment gateways like SecurePay include risk management and security features to detect and prevent fraudulent transactions, as international transactions can be more susceptible to fraud.

Reporting and analytics: Use simple reporting tools to track your international sales and analyse customer behaviour in different regions.

Settlement: After a successful transaction, the payment gateway handles the settlement process, ensuring that your business receives the funds in the chosen currency. SecurePay will always settle in AUD.

How multi-currency payment gateways work

When a customer from another country visits your website, the multi-currency payment gateway detects their location based on IP address or other indicators. The gateway displays product prices, shipping costs, and other relevant information in the customer's local currency. This way customers gain a clear understanding of how much they are paying.

Multi-currency payment gateways use real-time exchange rates to convert the transaction amount into the merchant's chosen currency. This ensures accuracy and transparency in the conversion process. Once the customer makes a purchase, the payment gateway processes the payment in the local currency and converts it at the current exchange rate. After successful payment processing, the gateway handles the settlement process, ensuring that you receive the funds in your chosen currency which also simplifies the accounting and financial aspects of international sales.

Benefits of multi-currency payment gateways

Global reach

Multi-currency payment gateways empower your business to expand your reach to international markets. This means tapping into a broader customer base and increasing the sales potential.

Enhanced user experience

By displaying prices in customers' local currencies, businesses can provide a user-friendly and familiar shopping experience. Customers appreciate the convenience of shopping in their own currency without having to perform manual conversions.

Increased conversion rates

A seamless shopping experience with localised pricing can lead to higher conversion rates. When customers can easily understand the costs involved, they are more likely to make a purchase. This also creates trust and transparency towards your brand and offering.

Reduced cart abandonment

Complex and unfamiliar currency conversions at the checkout stage can lead to cart abandonment. Multi-currency payment gateways reduce this risk by simplifying the payment process.

Choose SecurePay’s multi-currency payment gateway

Expand your business reach to international markets, offer a seamless checkout experience for customers worldwide, and increase your sales by accommodating shoppers who prefer to pay in their local currency. SecurePay’s flexibility is essential for ecommerce companies looking to tap into the global market and serve a diverse customer base.