Payments

Choose online payment methods for your small business

Select multiple online payment methods for your small business and give your customers the flexibility to pay with their preferred payment option. Embracing more options can open many opportunities, expand your customer base and boost your sales. Offer your customers the ability to shop conveniently and quickly and being able to pay anytime from anywhere.

Online payment services pricing

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for online payment processing.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Grow your business with a wide range of payments options

Future-proof your small business and set it up for success by offering your customers more choice when checking out. This includes credit card and debit card payments, Apple Pay and PayPal.

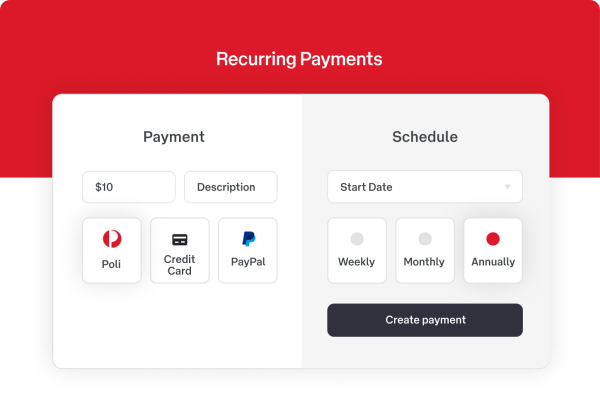

All-in-one online payment system

SecurePay offers payment processing services as a complete merchant payment solution or as a payment gateway only service. Additionally, SecurePay enables direct debit payment processing and recurring payments online.

Ready to implement SecurePay’s trusted online payment services?

If you own a small business or ecommerce platform, implementing online payment methods and choosing from a variety of options is a necessity. It’s common for customers to make cashless transactions and offering diverse and convenient payment options can significantly enhance your small business' positioning in the market. Increase your customer satisfaction and explore various online payment methods suitable for your business.

The importance of online payment methods

Small businesses should invest some time to research and find the best online payment methods that your customers prefer and integrate seamlessly with your payment platform. Making online payments should be a smooth and efficient process for your customers.

Online payment methods provide your small business with a multitude of advantages. They broaden the horizons of sales opportunities by appealing to all types of customers, especially those who prefer the convenience of online shopping and remote transactions. This not only enhances revenue prospects but also supports your business growth. In a digital era where customers look for convenience, online payment methods allow users to make purchases from the comfort of their homes or while on the move.

Managing your finances also becomes easier, as online payments are typically processed in real-time and could be settled in your bank account within 24hrs. This includes the transfer of funds into your business bank account, contributing to improved cash flow and streamlined financial processes. Online payment providers often offer robust security features that can significantly reduce the risk of fraud and chargebacks. The added layer of security provided by a trusted payment platform such as SecurePay is not only great for businesses but also keeps your customers sensitive and personal information protected.

Popular online payment methods for small businesses

Choosing the right online payment methods for your small business is key. Here are some popular options to consider:

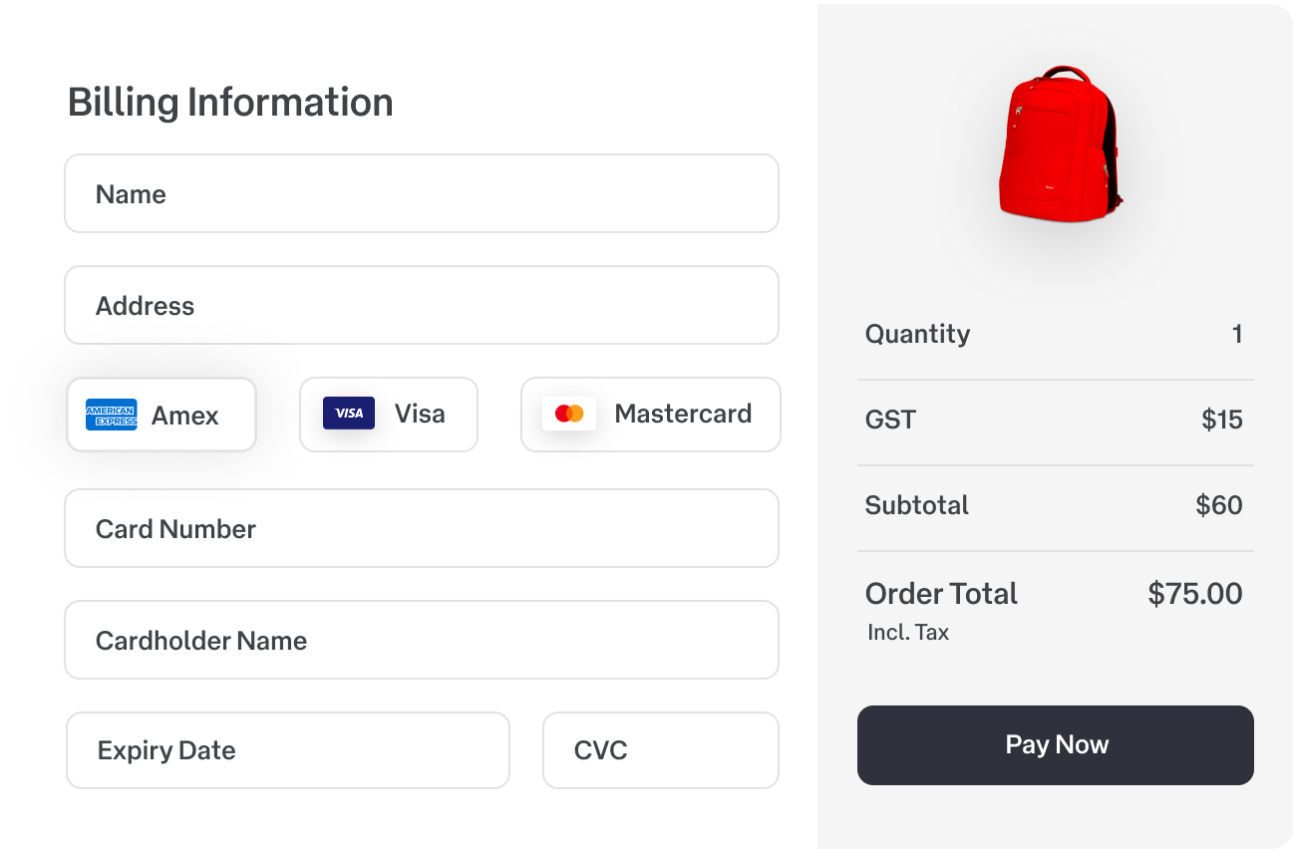

1. Credit and debit card payments

Accepting credit and debit card payments is a fundamental online payment method for businesses of all sizes. Whether you have an existing merchant account and are only looking for a payment gateway provider, or are searching for an all-in-one payment solution, SecurePay offers easy integration into your websites, making it very convenient for customers to pay. Common credit and debit cards include Visa, Mastercard, American Express and JCB.

Benefits:

Widely accepted by customers

Secure and efficient

2. Digital wallets

Digital wallets like Apple Pay and PayPal allow customers to make payments using their smartphones or wearable devices. Customers can link their bank accounts or credit cards to these wallets and make payments securely. These apps are becoming increasingly popular and can be easily integrated into ecommerce websites.

Benefits:

Convenient for customers on the go

Enhanced security features like biometrics

Trusted and recognised by customers

Provides payment protection

3. Phone payments (IVR)

Although there are various online payment methods available, paying through the phone is still a preferred method for many potential customers. Unlike mobile payment apps, phone payments or IVR payments guide the customer through an Interactive Voice Response (IVR) to complete a transaction.

Benefits:

Step-by-step payment guidance

Provides accessibility

Integrating online payment methods with your business platform

Selecting the right online payment methods is only the first step. Implementing them effectively is equally important. Easily set up, customise and integrate your small business platform with SecurePay.

Understand your customers

When choosing payment methods and looking at different aspects, it’s helpful to understand your target audience. For example, are they tech-savvy people who prefer mobile payments, or are they more comfortable with traditional credit card transactions? Knowing the amounts they are willing or capable to spend on your business offering can also be a factor to consider when deciding on payment methods. The essential outcome should be to tailor your payment options to your customers preferences.

Ensure website security

Security is absolutely important in online payments. Choosing SecurePay for your payment gateway gives you access to a payment gateway that follows the highest global security standards. Security and fraud protection, encryption methods and data-driven authentication keep any sensitive financial data protected and compliant with international practices.

Improve customer experience

To ensure a seamless experience, it’s always good to test the payment process from a customer perspective. Fix any blockers, review if the process is intuitive or reduce the journey towards making a payment where possible. Make sure the checkout process works smoothly on both desktop and mobile devices. SecurePay features a customisable checkout experience to match the payment interface with your brand.

Monitor the payment process

Regularly checking in with your online payment processes and analysing transaction data is a major task for small businesses starting to use online payment methods. Simple reporting tools help you identify trends, track conversion rates and address any issues promptly to improve the payment experience for your customers throughout.

SecurePay supports small businesses

Get started with online payment methods for your small business and integrate a variety of payment options. Improve customer satisfaction and enhance your business competitiveness, by carefully selecting and implementing the right online payment methods. With high-standard security and convenient user journeys, small businesses can thrive in local and international markets alike. Stay informed about emerging payment technologies and adapt your strategies to meet the evolving needs of your customers with SecurePay – giving your customers the flexibility to pay how they like.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.