Payments

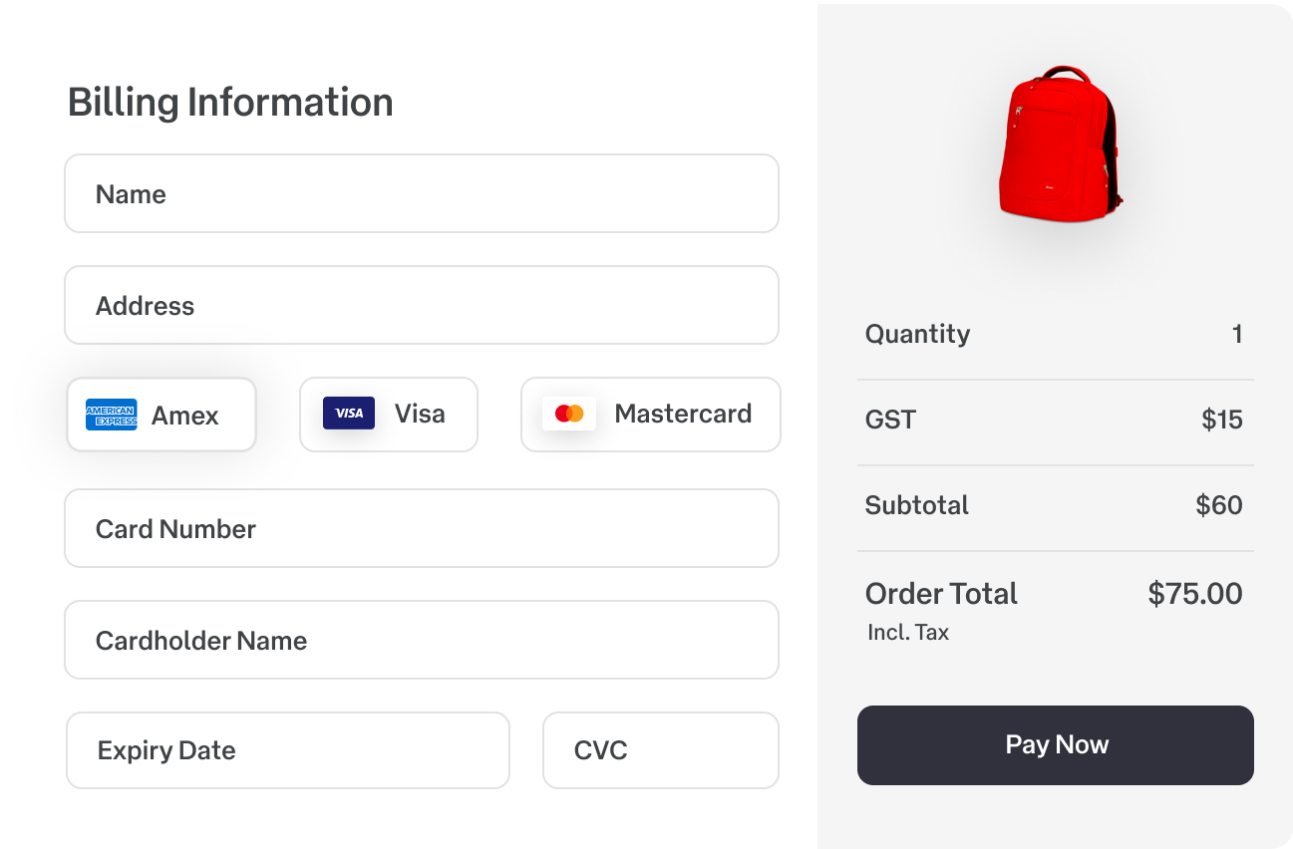

Create a better payment experience for your customers

Process online transactions quickly and safely with SecurePay. Manage recurring payments, offer multiple payment methods, integrate international currencies and customise the experience all in one payment gateway platform.

Payment gateway pricing

Experience transparent pricing with SecurePay's online payment gateway services. We use a straightforward per-transaction pricing model, with no regular, setup, or hidden fees.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

The power of payment gateways and payment processors

The power of payment gateways and payment processors makes it easier and faster to manage online transactions. SecurePay provides user-friendly payment solutions with real time transaction processing – levelling up your ecommerce store or subscription-based service.

Secure online payments for your business

As a trusted payment gateway provider, we keep sensitive personal data protected from potential fraud throughout the entire online payment process. Leveraging payment gateway benefits, everyday online payments are processed seamlessly and securely. SecurePay follows international standards for the highest level of financial security and fraud protection.

Ready to use SecurePay’s secure payment gateway?

Whether you're running an ecommerce store, managing a subscription-based service or simply offering goods and services online, you interact with payment systems regularly. Payment gateway and payment processor are crucial components of online payments but they serve very specific different purposes in the payment ecosystem.

Key features of payment gateways

An online payment gateway essentially acts as a bridge between the company’s online platform (usually the website) and the financial institutions involved in processing the payment. It handles the secure transmission of payment data from the customer to the payment processor and back.

Security: Payment gateways add various security measures such as encryption to protect sensitive payment information – for example credit card details – and making sure any financial data is protected from unauthorised access or potential fraud.

Compatibility: They are compatible with different payment methods, including credit cards, debit cards, digital wallets and direct debit.

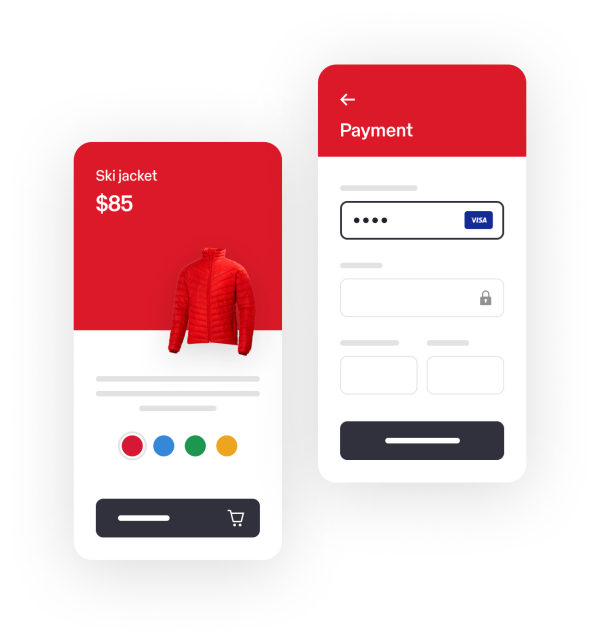

User experience: A well-designed payment gateway creates a seamless and user-friendly payment experience for customers, helping with the business sales journey.

Integration: Payment gateways can be integrated into various digital platforms, most commonly ecommerce websites and mobile apps.

Transaction reporting: Gain insights into transaction reports to analyse sales performance and identify strategies.

Key functions of payment processors

The payment processor is responsible for the actual processing of the transaction. It acts as an intermediary between the merchant and the issuing bank or card networks, managing the movement of funds during the transaction process.

When the payment processor receives the encrypted payment data from the payment gateway, it starts the transaction process by sending the information to the relevant card networks or the customer's issuing bank.

Authorisation: Payment processors assess whether a transaction can be approved or declined based on various factors, including available funds, card validity or potential fraud patterns.

Settlement: After authorisation, the payment processor captures the funds and initiates the settlement process. This is the process of transferring funds from the customer's account to the merchant's account.

Reconciliation: A payment processor also ensures that all transactions are accurately recorded and reconciled to avoid discrepancies.

Dispute resolution: They handle chargebacks and disputes between merchants and customers.

How payment gateways and payment processors work together

The payment gateway takes charge of the transaction, securely transmitting the encrypted payment data to the payment processor. The payment processor is responsible for verifying the transaction's legitimacy and takes care of the transaction’s actual processing and settlement. The entire process between payment gateway and payment processor happens within seconds, enabling smooth and seamless online transactions between a business and customer.

In many cases, payment gateways and payment processors are part of one system, making it easier and faster to manage transactions effectively. They both implement security measures to protect sensitive data and actions from potential fraud throughout the transaction process.

The distinction between a payment gateway and a payment processor lies in their core functions within the online payment ecosystem. Together, they offer customers a greater payment experience that supports the delivery and sales of services and products across your business.

Optimise your customer’s payment experience with SecurePay. We support you with your payment gateway integration and help you find the best online payment processing for your business. A product of Australia Post, SecurePay is there to help you accept online payments and to answer all of your questions about payment solutions. SecurePay is a flexible, easy to integrate and secure ecommerce payment gateway provider.