Payments

Grow your business with subscription payments

Scale your success with subscription payments, gain a reliable revenue stream, foster customer loyalty and increase business efficiency through financial automation.

Subscription payment system pricing

SecurePay uses a per-transaction pricing model for its online payment gateway. A transaction fee for direct debit transactions will apply.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Simple automated subscription payments

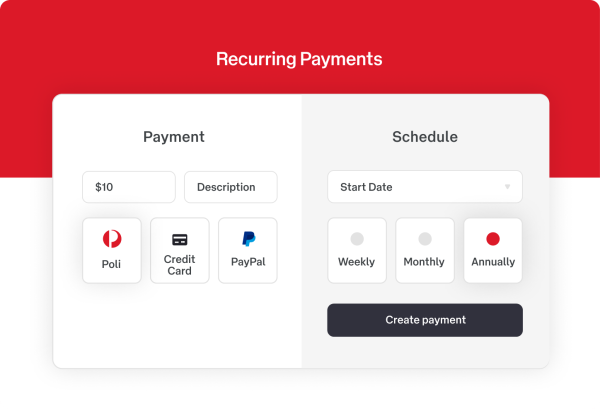

Offer your customers greater flexibility and peace of mind through automatic payments. Once subscribed, your audience can opt for recurring card payments or direct debit payments to seamlessly pay for your offering and enjoy it on a regular basis. Ready, set and forget!

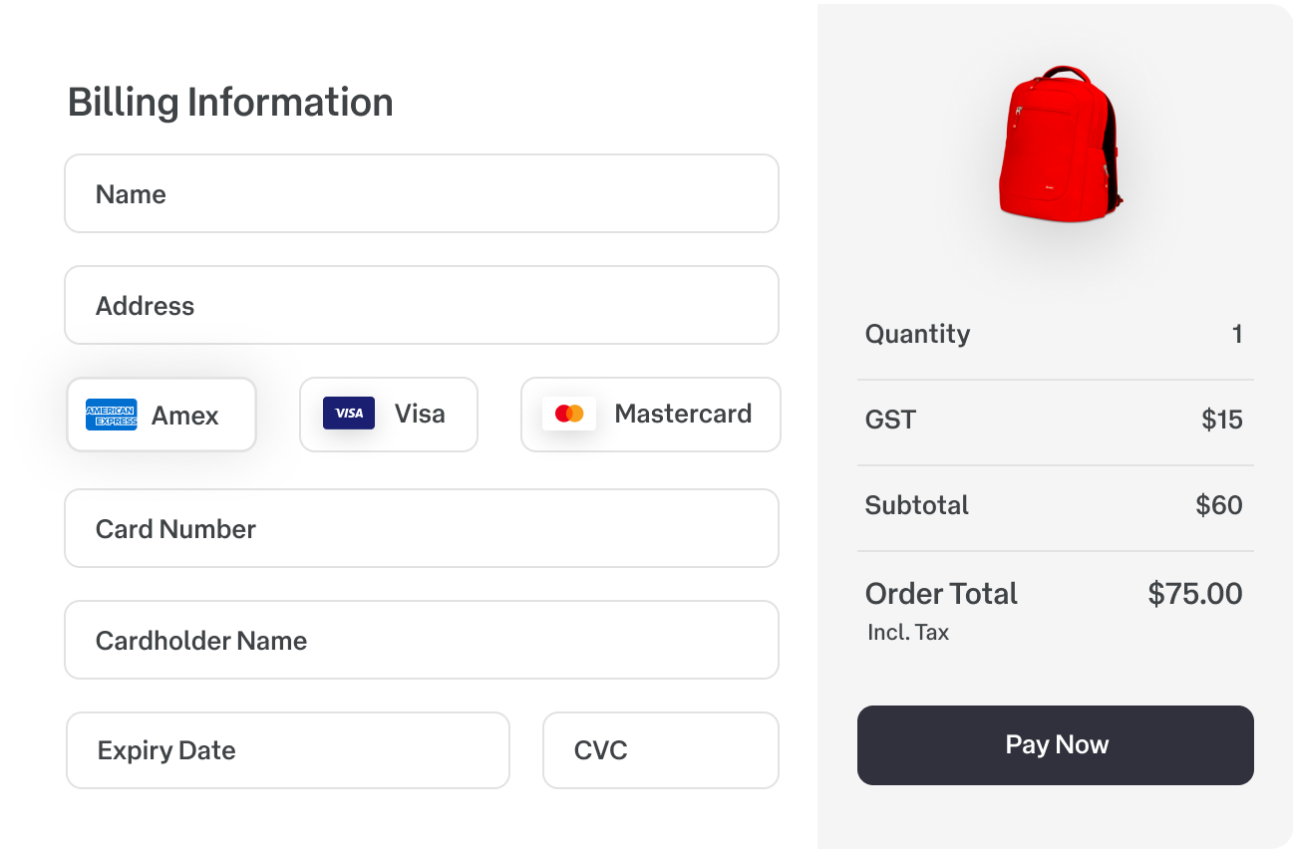

SecurePay makes it easy to get started, seamlessly integrating your business with a subscription-based payment process that works on any website type. Benefit from customisable checkouts and ecommerce extensions that create a unique payment experience.

Ready to start accepting recurring payments?

What are subscription-based services?

Subscription-based services involve offering your products or services to customers on a recurring basis in exchange for a regular fee that is paid in intervals (such as weekly, monthly, quarterly or annually). They are not limited to any specific industry. Subscription payments can be applied to various sectors, including software, streaming services, ecommerce, meal kits, fitness, delivery services, memberships and more. This model is commonly used to provide ongoing value to customers and generate a steady and predictable revenue stream for the business.

Common subscription-based business models

Personalised subscription boxes

Many companies now offer subscription boxes that curate products based on individual preferences and interests. These boxes often contain anything from skincare products to international snacks. By tailoring the content to each subscriber, businesses create a sense of excitement and anticipation, enhancing the overall subscription experience.

Subscription-based marketplaces

Some platforms have emerged as subscription-based marketplaces where customers pay a monthly fee for access to a variety of products or services from different brands. These marketplaces offer subscribers convenience and choice, making them an attractive option for consumers seeking value and flexibility.

Subscription-based add-ons

Businesses that offer complementary products or services can introduce subscription-based add-ons. For example, you can provide a subscription service for premium customer support or access to additional features. This approach allows you to diversify your revenue streams while offering valuable extras to loyal customers.

Top 5 subscription payments benefits and how they can enhance your business

By offering products or services through subscription models, businesses can not only secure a stable income but also build stronger customer relationships.

1. Predictable revenue

One of the most significant advantages of subscription payments is the predictable revenue they provide. Unlike traditional sales, where income can fluctuate greatly from month to month, subscription models offer a stable income stream. This predictability allows you to plan your business finances in more detail, allocate resources effectively, and make informed decisions about growth and expansion.

2. Customer retention

Subscription-based businesses focus on building long-term relationships with their customers. When people subscribe to a service, they are more likely to remain loyal and continue using it over time. This loyalty can result in higher customer retention rates, changing the growth strategy about how quickly and often your business needs to acquire new customers.

3. Recurring payments

Customers pay a regular subscription fee to access your products or services. As a subscription-based business, recurring payments are typically automated, making it convenient for both customers and businesses.

4. Data and insights

Subscription models provide valuable customer data. Analyse customer behaviour and subscription payment growth using simple reporting tools that help you make data-driven decisions for your business. Knowing these insights allows you to tailor your offerings that resonate with your subscriber base.

5. Scalability

Subscription-based businesses can scale more efficiently than those relying solely on one-time sales. As your subscriber base grows, so does your revenue. For example, scaling can be achieved by adding more subscription tiers, expanding into new markets or accepting a wide range of payment methods.

How to add a subscription payments model to your business

Adding a subscription payments model to your business can be a strategic move to generate recurring revenue, enhance customer loyalty and increase the long-term sustainability of your venture. Explore various strategies to effectively implement subscription-based services.

Understand whether subscription payments are for you

Start by identifying your target audience and niche market. Understanding your customers' needs and preferences is important when designing subscription offerings. Subscription payments have to align with your business goals and offering too. Do your business products or services fit into a recurring payment system? Conduct market research and gather customer feedback to tailor your products or services accordingly.

Create compelling subscription tiers

Offer multiple subscription tiers to cater to different customer segments and budgets. Make sure that each tier provides varying levels of value to justify the price difference. This approach allows you to attract a broader range of customers while maximising revenue potential. It’s also a great way to put your offering into a different perspective for your target audience by detailing the value of each tier.

Pricing strategy

Develop a pricing strategy that aligns with your offerings and market dynamics – and customer feedback if available. Consider factors such as production costs, competitor pricing, perceived value and what your target audience is willing to pay. Using tiered pricing options with varying features or benefits can be a useful subscription payment method that your customers can choose from.

Offer flexibility

Customers appreciate flexibility in their subscriptions. Allow subscribers to upgrade or downgrade their plans, pause their subscriptions, or skip a month if needed. This flexibility can lead to higher customer satisfaction and longer subscription durations.

Free trials and discounts

To encourage customers to try your subscription, offer free trials or introductory discounts. These strategies can help potential subscribers experience the value of your offering without committing immediately. Ensure that the trial period is long enough for customers to form a connection with your product or service.

Set up automated payments

A smooth subscription process helps new customers to subscribe and to retain existing subscribers. Use automatic payment features to generate revenue on autopilot. SecurePay offers two different ways that enable automatic payments, recurring card payments and direct debit payments.

Subscription payments offer a strategic advantage and by implementing the right strategies and staying innovative, you can leverage subscription payments to grow your business and establish a loyal customer base. Whether you're starting a new venture or looking to transform your existing business, SecurePay sets you up for success with flexible payment methods and automatic processes.